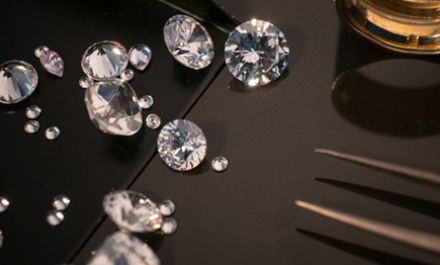

The Chinese government has announced the termination of preferential tax policies for diamonds imported through the Shanghai Diamond Exchange (SDE), effective November 1, 2025.

The country’s Ministry of Finance, General Administration of Customs and State Taxation Administration jointly declared the abolition of Articles 1, 3, 4, 5, and 7 of the “Notice on Adjusting Tax Policies Concerning Diamonds and the Shanghai Diamond Exchange (Financial Tax [2006] No. 65)". This decision marked the end of SDE’s 18-year exemption from import taxes on rough diamonds and its 4 per cent discount on import taxes on polished diamonds.

Moving forward, both rough and polished diamonds entering the Chinese market from overseas will be subject to a 13 per cent import value-added tax.

Initially introduced in 2006, the preferential tax policy aimed to establish SDE as China's primary diamond import and export platform, offering the diamond industry extended periods of low taxes at the point of import to position China as the diamond trading hub of Asia.

The policy shift is expected to significantly impact various sectors within the traditional diamond trade.

According to Shanghai Customs, China saw a decline in diamond import value over the past three years due to various factors. The market however improved in 2025, showing robust growth momentum.

Data from Shanghai Customs revealed that, in the first eight months of 2025, the value of natural polished diamonds imported through SDE’s general trade reached RMB2.35 billion (approximately US$33.12 million), representing a 41.5 per cent year-on-year increase. This reflected renewed vitality in China’s diamond import market.

Hong Liang, assistant to SDE president Lin Qiang, said, “Since the beginning of 2025, there has been a steady recovery in global diamond demand, alongside reduction in retailers’ diamond inventories, rebound of consumer confidence, and increased asset allocation for investment and collector-grade diamonds. Transaction volume at the SDE reached US$1.5 billion in the first eight months of the year, indicating a stabilising and improving trajectory in trading activities.”