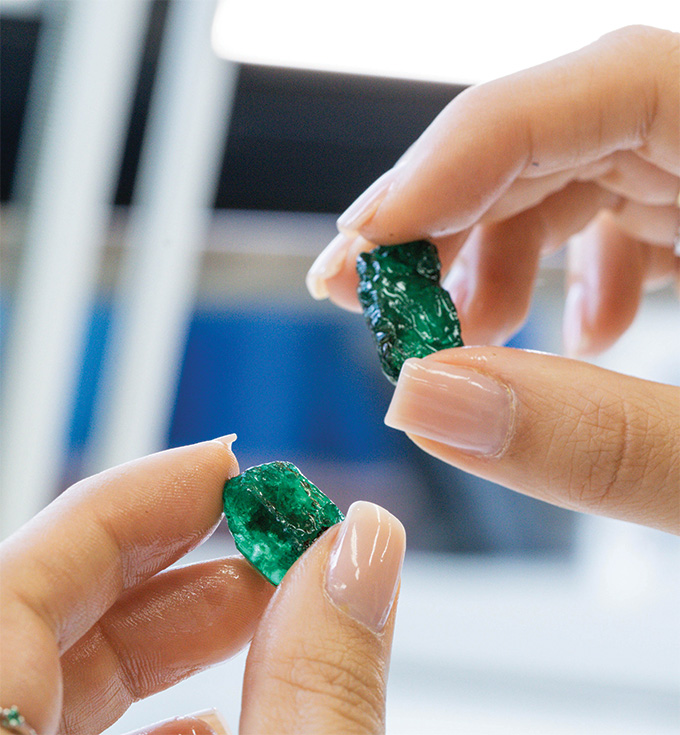

Emerald specialist Belmont is elevating Brazil’s coveted green gem to loftier heights through sustainable and advanced production techniques and international expansion.

This article first appeared in GEMSWORLD 2026.

Belmont Emeralds is on a mission to strengthen global demand for emeralds – one of Brazil’s prized gemstones. Already recognised as top-performing gems, emeralds experienced solid growth in 2025, driven by consumers’ heightened appreciation for rarity and provenance, combined with prevailing fashion trends.

According to Marcelo Ribeiro, president of Belmont Emeralds, Brazil is a top source of fine emeralds, with major markets India and Europe fuelling demand. The US, meanwhile, remains a key destination for high-end coloured gemstone jewellery.

Premium-quality, traceable emeralds were among the fastest moving in the emerald trade in 2025 as they appeal to brands and consumers focused on ethical sourcing, according to Ribeiro. “However, challenges persist, including market fluctuations, logistical costs and the need to implement responsible mining practices amid expanding production,” he added.

Supply and demand

Emerald production at Belmont remained stable, thanks to ongoing investments in mining and geological mapping, and efficient recovery. Exports performed well too, reflecting rising demand for sustainably mined and traceable emeralds.

Approximately 95 per cent of Belmont’s rough emeralds are exported to India for cutting and polishing while the remaining 5 per cent goes to select projects, including local cutting for strategic partnerships and collaborations with fine jewellers seeking full mine-to-market traceability.

Belmont’s two exclusive tenders held in Bangkok in 2025 demonstrated robust market appetite for Brazilian emeralds, especially for vibrant, clean stones.

The company sold 100 per cent of total lots offered, indicating solid demand across the board. “All materials were highly sought after, from lower-grade rough to premium emeralds intended for high jewellery houses,” explained Ribeiro. “Overall market sentiment was optimistic, with participants recognising the stability and reliability of Belmont’s tender model.”

Prices have risen by 30 per cent from pre-pandemic levels, the company said.

The road ahead

US tariffs remain a challenge for gemstone traders. For Belmont, tariffs on India – its main buyer of rough emeralds – is a major hurdle. US-India negotiations, however, are ongoing and Ribeiro expressed optimism that India could secure an exemption.

The issue also underpins the need to explore new opportunities, strengthen ties across Asia and Europe and build greater resilience against regional trade fluctuations.

“Diversification should be a strategic priority for the gemstone industry. In this way, Belmont can mitigate the risks of regional dependency while strengthening its global positioning as a reliable supplier of premium, traceable emeralds,” noted Ribeiro.

While the US remains an important market, Belmont is expanding in Southeast Asia and India, where demand for Brazilian emeralds is rising and consumers are becoming more discerning and knowledgeable.

“This sentiment is shared by local gemmological laboratories in China, which have been issuing more emerald reports,” the company official said. “Asia is partial to mid- to high-quality emeralds with good transparency in big sizes.”

Technology and sustainability are also key strategies. Belmont is investing heavily in innovation while reinforcing partnerships with brands that share its values. It joined the Responsible Jewellery Council (RJC) in 2025.

Meanwhile, Belmont Mine, which runs entirely on renewable energy from the company’s 1.5MW solar power plant, continues to set an industry benchmark.

Belmont’s other initiatives include land rehabilitation, biodiversity preservation, efficient resource management and community engagement through training and education.

Despite global uncertainties, Ribeiro maintains a positive outlook for 2026 as demand for coloured gemstones sustains momentum. “Belmont's long-term commitment to ethical practices positions the company to lead this evolution, ensuring both market resilience and continued global recognition for Brazilian emeralds,” he remarked.