Adaptability, business agility and a visionary spirit are keys to sustaining growth amid an extremely challenging economic and political environment, according to Turkish jewellers.

This article first appeared in the JNA March/April 2024 issue.

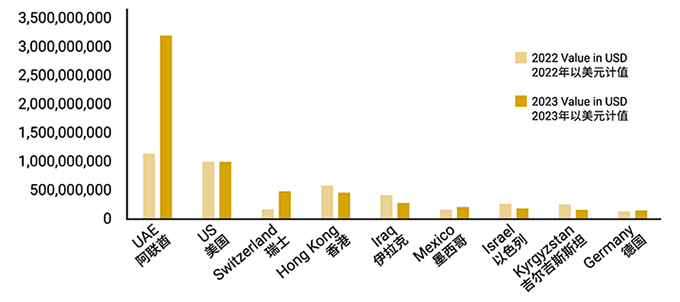

Turkish jewellers are proud of what they have achieved in 2023 – a particularly difficult year for global businesses. Türkiye’s jewellery exports grew from strength to strength, registering an impressive 30 per cent year-on-year upsurge to US$7.6 billion last year compared to US$5.8 billion in 2022, data from Türkiye Exporters' Assembly showed.

Jewellery shipments also accounted for 3.2 per cent of Türkiye’s total exports. And while majority of Türkiye’s export categories were adversely affected by local and global challenges, the jewellery sector was the third best-performing sector overall in 2023.

Sirzat Akbulak, manager at Turkish Jewellery Exporters’ Association, attributed the continued strength of Turkish jewellery exports to a highly resilient industry that relies on distinct Turkish craftsmanship and business agility.

The past year proved extra challenging for Türkiye. On February 6, 2023, a devastating 7.8-magnitude earthquake hit Türkiye and Syria, killing more than 40,000 people and obliterating entire cities. Kahramanmaraş, an important production and export base for the jewellery trade, was severely impacted by the disaster. The Russia-Ukraine war was also at its height in 2023.

“Crucial markets like Russia, Ukraine and the Middle East, including Israel, struggled with wars. There was also some difficulty in importing gold,” noted Akbulak. “Despite these challenges, we managed to successfully conclude the year 2023.”

Emerging markets, popular products

The association also saw significant developments in other markets, most notably in the Far East, including the Philippines, and South America. Specifically, Mexico and Brazil – which are first-time trade partners for Turkish jewellers – proved promising.

Türkiye’s traditional markets are the US, the UAE, Hong Kong, Germany, the UK and Iraq.

“Russia and Israel are valuable business partners for Türkiye. We want to further bolster our trade with them, but the current situation is unfavourable,” explained Akbulak. “However, losses were also offset by gains in the UAE, the UK and Switzerland.”

Highly favoured products in 2023 were gold jewellery, which Türkiye specialises in, as well as jewellery mountings. These had a significant share in total jewellery exports in 2023. Meanwhile, an uptick in diamond jewellery shipments was also recorded.

Gold supremacy

The jewellery export market in 2023 performed better than the year prior as global markets gradually return to normalcy, with people travelling again, spending money and doing business overseas, said Cevat Genc of Cehverun.

The company, whose main customers are from Hong Kong, the US, the Middle East and China, offers plain gold jewellery as well as diamond and coloured gemstone pieces. According to Genc, gold jewellery is more popular in the US and China. “Both segments are received well by our clients. Our designs are exceptional, so there is not much competition from other companies,” he noted. “My collections are suited for a wide range of buyers as the designs are versatile.”

Especially sought after are Cehverun’s traditional designs in pure gold, inspired by ancient Hellenistic, Byzantine, Roman and Ottoman culture. Various other pieces, meanwhile, take cues from modern design elements.

“Turkish jewellers will not sway away from offering traditional/cultural pieces, but we are increasingly selling more contemporary pieces. We have every kind of jewellery – from 10-karat to 24-karat gold,” said Genc.

Sejfula Bushi, general manager of ANNDA Jewellery, likewise observed strong fascination for gold jewellery. In ANNDA’s case, demand was highest for 14-karat gold jewellery pieces, driven primarily by consumers seeking a balance between quality and affordability.

He explained that 14-karat gold, known for its durability and rich colour, has become a favourite among a younger generation of buyers and in Western markets. Buyers mostly prefer delicate, fine jewellery pieces like thin chain necklaces, stackable rings and small, elegant earrings.

According to Bushi, the year 2023 also witnessed significant growth in bespoke and high-quality craftsmanship. “In 2023, our growth was bolstered by the Middle East and North America. These regions showed a strong appreciation for the unique blend of traditional and modern designs that Turkish jewellery offers,” said Bushi. “Additionally, emerging interest from Asian markets, especially Hong Kong, also contributed to our growth.”

Lab-grown diamonds

One of the pillars of Türkiye’s jewellery industry is the mounting sector and these days, companies are finding fresh possibilities in the emerging lab-grown diamond segment.

According to Mustafa Akin, founder of jewellery mounting manufacturer Sade Is Kuyumculuk, the Turkish mounting sector is on a growth trajectory, thanks to solid demand for lab-grown diamonds. This was an important segment for Sade Is.

“We experienced a high volume of business in 2022 and 2023. Last year, a critical factor for us was the rise in prominence of lab-grown diamond jewellery,” noted Akin. “The mounting business is benefitting tremendously from this sector.”

Akin estimated business to have grown by 30 per cent to 40 per cent in 2023 alone. Among the most highly sought-after mountings are tennis necklaces and bracelets, bangles and statement necklaces.

Majority of Sade Is’ lab-grown diamond clients are from India and the US, and some from Europe.

Natural diamond jewellery manufacturers, meanwhile, are regular customers of Sade Is. This segment of the business remains solid and steady, said Akin. Sade Is’ biggest markets are Italy, Belgium, Germany and the Far East, with a major part of this year’s growth strategy focusing on the European market.

He added that Sade Is produces 80 per cent of its mountings in 18-karat gold while the rest is in 14-karat gold. “In 2024, we are looking at sustaining this positive momentum,” remarked Akin.

Revitalised designs

Gold wedding band specialist Tarz Alyans, for its part, attests to the steady growth of Türkiye’s jewellery exports sector. The company has a dynamic customer portfolio, spanning Canada and the UK as well as other European, Middle Eastern and Asian markets.

Buyers would opt for anywhere between 10 grams and 20 grams for a pair of gold wedding bands depending on specific preferences, according to Fahri Saygi, export manager at Tarz Alyans.

“There are customers who prefer lightweight gold jewellery, too. We have both collections – from lightweight to heavier gold rings,” noted Saygi. “You have to constantly innovate and offer a wide range of products because buyers from different markets will want different items.”

India, for instance, would go for heavier rings as it mostly uses 18-karat to 22-karat gold jewellery. Other markets, meanwhile, normally require 9-karat to 14-karat gold rings.

Business climate in 2024 could remain challenging, noted Sagyi, hence the need for more inventive business strategies. Tarz Alyans is also streamlining its jewellery exhibitions throughout the year to maximise its presence in target markets.

Growth trajectory

Akbulak of the Turkish Jewellery Exporters' Association said Türkiye’s jewellery sector will likely face economic and political upheavals in 2024 such as worldwide elections, inflationary challenges and ongoing wars.

A more favourable 2024, however, is expected on the back of significant steps taken by Türkiye to tighten its fiscal policies to lower inflation and spur economic growth. The country’s year-on-year inflation rate reached 64.8 per cent in 2023, the highest since November 2022.

“The first quarter of the year may be challenging, but we expect a more relaxed trading environment, especially after our local elections scheduled for March 2024,” noted Akbulak. “If improvements continue, we could see jewellery exports exceeding US$8 billion. Meanwhile, positive international developments could potentially push it to the US$10-billion mark.”

Bushi of ANNDA, for his part, expects the trend favouring 14-karat gold jewellery to continue in 2024 alongside a growing interest in personalised and custom-designed pieces that reflects a desire for unique and meaningful jewellery pieces.

ANNDA is preparing to launch new collections that align with these current trends as well as exploring the use of alternative, eco-friendly materials in line with evolving consumer preferences towards sustainability and individual artistic expression.

“For 2024, we expect digital transformation and online retail to be important growth drivers as well as expansion into underpenetrated markets,” shared Bushi. “Challenges would likely include managing supply chain complexities and adapting to the evolving global economic landscape.”