Gemstone miners are ramping up production to meet strong market demand for coloured gemstones as evinced in this year’s record-breaking auction results. New gemstone deposits meanwhile open up a world of possibilities for the jewellery trade.

This article first appeared in the JNA July/ August 2022 issue.

Demand for coloured gemstones is outstripping supply as the market restocks after production challenges and travel restrictions at the height of the Covid-19 pandemic. Gemstone miners are registering strong – often record-high – sales at 2022 auctions while new and upcoming goods are poised to offer the trade and consumers greater variety for their coloured gem needs.

Operations at Gemfields’ Kagem emerald mine in Zambia and Montepuez ruby mine in Mozambique have returned to pre-pandemic levels. According to Gemfields CEO Sean Gilbertson, Kagem is expected to yield 37,993,000 carats of emeralds and beryls this year while the 2022 target at Montepuez is 1,073,648 carats of rubies and corundum.

Both mines suspended operations in March 2020 and saw a phased resumption of principal operations a year later, reaching normal capacity by the end of May 2021.

Sales records

Travel restrictions, quarantine periods and congregation limits due to the pandemic disrupted Gemfields’ auction calendar, forcing it to pivot to online auctions and a re-mapped schedule.

In 2020, Gemfields held its Kagem commercial-quality auction in February and then switched to a series of smaller multi-city auctions that November and December to sustain business amid lockdowns and other pandemic-related challenges. The following year, it achieved record-breaking auction revenues – a trend that continued into 2022. “The success of our multi-city auctions, combined with the introduction of an online bidding system, has provided greater flexibility for the Group in the ever-changing circumstances we encounter,” revealed Gilbertson.

Sales this year have surpassed pre-Covid results. Gemfields’ revenue from its two Kagem emerald auctions and one ruby auction in the first half of 2022 reached US$181 million, beating its prior record of US$93 million set in the first half of 2018.

In May, Kagem’s emerald auction in Bangkok, Thailand – its second emerald auction in 2022 – set new records for the highest revenue and the highest average price per carat achieved at any of Gemfields’ 41 Kagem auctions since July 2009.

Kagem’s auction revenues for the first half of 2022 stood at US$85.7 million, compared to US$92.3 million for the entire 2021. Meanwhile, Gemfields’ ruby auction in June brought in US$95.6 million, a new revenue record for any Gemfields auction.

“These results reaffirm the remarkable levels of demand prevailing in the emerald and ruby markets. Demand has been driven by the ability of customers to travel and meet again after the challenges that had been brought upon by the Covid-19 pandemic,” said Gilbertson.

According to the company official, all qualities and sizes of Gemfields’ Zambian emeralds and Mozambique rubies have been moving extremely well in the market. “There has been strong demand coming from China as the Chinese luxury goods market continues to grow. China is increasingly becoming a strong consumer of our gemstones, as they can find a stable and reliable supplier in Gemfields,” he added.

Blue wonders

Spinel and peridot – two gemstones that are soaring in popularity – are also getting a significant supply boost with the discovery of new deposits of quality material.

Mahenge Gems has brought to market cobalt spinel from a new deposit approximately 12.5 miles southeast of Mahenge, Tanzania.

From October 2021, miners started bringing in sizeable specimens of blue crystals suspected to be the rare cobalt spinel rather than the regular blue spinel. Swiss Gemmological Institute SSEF conducted a detailed analysis of a selection of the material, confirming cobalt as the main colouring element (chromophore), in combination with iron.

SSEF found that the inclusions in these Tanzanian cobalt-blue spinels had similarities to the red spinel from Morogoro in eastern Tanzania, namely oriented geometric lamellae with interference colours together with lines of fine particles. Through Raman spectroscopy, SSEF also found colourless apatite and clusters of small zircon inclusions.

“Cobalt-blue spinel from this new source in Tanzania is a welcome and attractive addition to the trade,” said SSEF Director Dr. Michael Krzemnicki. “It is also fascinating material for us gemmologists to study, as these spinels display specific gemmological characteristics that are helpful for origin determination.”

Though chemically similar to the cobalt-spinel material from sources in Vietnam, the Tanzanian stones come in 1 carat to 40 carats, and their colours have ranged from a neon electric blue to a denim blue. Cobalt blue spinels from Vietnam’s Luc Yen district are usually 1 carat and below. And while they are often described as a “neon, Windex-y blue,” they tend to be lighter and more pastel than the electric blues recently discovered in Mahenge. Some of the newfound cobalt blue spinels are also neon and pure blues with no trace of grey.

Wez Barber, director of Mahenge Gems, said the Tanzanian cobalt spinels have caught the attention of collectors, investors and jewellery designers. “We are targeting primarily Japan, Europe and the US – mature markets that have a higher concentration of gemstone enthusiasts and professionals that understand the true rarity of this material,” he shared.

The trade price for the natural cobalt blue spinels from Mahenge Gems starts from US$2,000 per carat to per-carat prices that rival that of Vietnam’s Luc Yen cobalt spinels. Completely untreated, the gems are certified by SSEF, GRS GemResearch Swisslab AG and ICA GemLab.

Green option

Peridot meanwhile is the primary focus of Fuli Gemstones. The company’s Yiqisong Nanshan mining project located in the foothills of the Changbai Mountains in China is slated to commence commercial production in 2024, with a ramp up over six years to full capacity production of 300,000 tonnes of ore per year from 2030.

“Fuli Gemstones will be a dominant supplier of peridots in the global market once our mine reaches full capacity,” said Pia Tonna, the company’s chief marketing officer. “The sample testing during our mining exploration stage has suggested our mine can produce peridot in a variety of sizes. This will enable us to provide a consistent supply for the full spectrum of jewellery, from single, large gemstones for high jewellery suites through to stones below 1 carat for smaller calibrated goods.”

According to Tonna, Fuli Gemstones has a fully integrated business model, from mining and sorting to grading, cutting and polishing all the way to sales and marketing. It does not deal in rough. Cut and polished peridots, peridot gem dots and rough peridot gemstones will be its principal products. Fuli’s stones range from pure green to yellowish green, greenish yellow, brownish green and brown.

“Peridot is a truly natural gemstone. Unlike many gems sold today, heat treatments are not typically associated with peridot. The beauty admired in gem-quality peridot comes naturally. Typically, the only enhancements performed on peridot come from fashioning a cut stone and integrating it into a jewellery design,” she explained.

Till commercial production kicks in, the company is drumming up interest in peridot and positioning it as a fresh and vibrant gem.

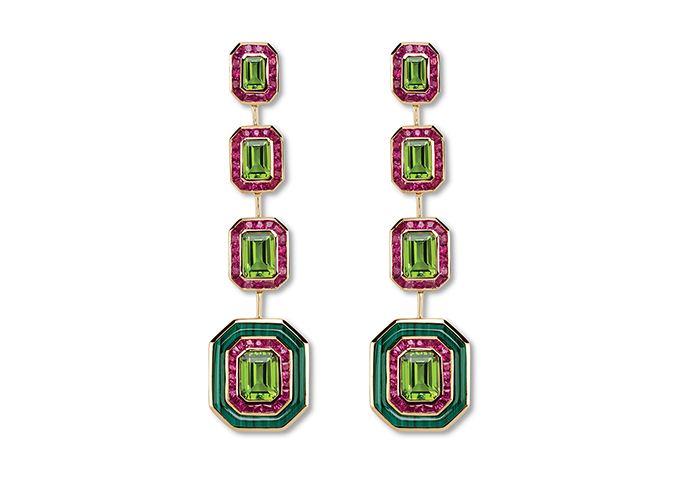

“For the last few years, we have been educating the industry and end-consumers on the history and background of peridot via our social media channels, designer collaborations and sponsorships. We are seeing highly respected, independent jewellers using peridot in their creations, for example, Taffin, Verdura and Hemmerle, as well as some young, up-and-coming designers,” said Tonna.

Fuli Gemstones also works with established and upcoming jewellery designers on pieces featuring stones from its initial sampling to raise awareness of peridots. Recent projects include the Magnipheasant red carpet necklace by Stephen Webster and a Toi et Moi ring by Aurelia & Pierre.

On top of participating in key trade shows, Fuli Gemstones will have its own online platform, where the gemstone trade will be able to access its inventory. It is also developing a traceability programme for its peridots.

Greater issues

Aside from commercial success and sufficient supply, gemstone companies count ethical mining and sustainability among their foremost objectives. Customer interest in wider industry matters such as traceability and supply chain transparency has actually increased since the lockdowns, noted Gilbertson.

Gemfields was a pilot partner of Gubelin’s traceability technology and is firmly committed to the betterment of the communities in which it operates, he said.

“Operationally, our Montepuez mine provides stable employment for approximately 1,426 people, 95 per cent of which are Mozambican nationals, receiving salaries above the living wage with working conditions that protect their health and safety. There are thousands of additional job opportunities that have been created for the local population in terms of the supply chain and services affiliated with the mine,” Gilbertson shared.

Gemfields’ community-based initiatives include creating a vocational training centre to help 2,100 young men and women over seven years, funding the construction of schools, establishing mobile health clinics and supporting local villagers during the pandemic.

Tonna of Fuli Gemstones notes that sustainability and ethical mining are the coloured gemstone industry’s responsibility to the planet and its inhabitants.

“Our mining operation uses mainly the cut-and-fill method of mining, and almost everything that is extracted from the mine tunnel is repurposed. As well as the gemstones, the basalt rock and olivine sand have various uses in industry. The basalt rock can be used for construction and the olivine sand is an environmentally natural abrasive alternative,” she said.

The road ahead

Coming off a stellar first-half, Gemfields is optimistic of further revenue gains in the last six months of the year, though perhaps at less lofty levels, Gilbertson said.

The company will continue to consolidate its position as a world-leading miner of responsibly sourced African emeralds, rubies and sapphires. Gemfields intends to introduce a second treatment plant at Montepuez, which is set to triple the mine’s production capacity. It also aims to secure an African sapphire licence to complete its ‘Big Three’ portfolio, Gilbertson revealed.

“Over the past few years, we have taken considerable strides in tailoring our portfolio to reflect our focus on the ‘Big Three’ coloured gemstones: Rubies, emeralds and sapphires, in our preferred origin of Africa. We remain keen to complete the ‘Big Three’ and are currently identifying suitable sapphire opportunities in Africa to complement our thriving ruby and emerald operations,” Gilbertson revealed.

Gemfields also aims to expand its marketing activities to boost demand for coloured gemstones and to develop the activities of Gemfields Foundation to benefit the communities and conservation efforts in sub-Saharan Africa, he added.

Mahenge Gems, for its part, is enjoying brisk business after a substantial slump at the height of the pandemic. Barber recalled that sales were limited during the lockdowns since the company did not want to change its business model. Mahenge Gems does not sell online and only deals with established regular clients.

Business has since picked up significantly, following a strong 2021. “We specialise in Tanzanian and east African stones. Pink and red spinels are always super popular and all markets are on the up,” Barber said.

Tonna of Fuli Gemstones is bullish on business prospects and prices of peridots moving forward. She noted that peridot prices are on the rise with a compound annual growth rate of approximately 5.4 per cent from 2010 to 2021 for larger stones. Market demand is also bolstered by jewellers and designers looking beyond emerald, sapphire and ruby for their creations, she added.