Gold jewellers from Hong Kong, Malaysia and Türkiye are responding to the market’s heightened fascination with gold through new manufacturing techniques, innovative designs and multi-channel strategies.

This article first appeared in the JNA May/June 2025 issue.

The jewellery sector is aglow with opportunities from sustained market demand for gold. And with advancements in manufacturing, design and technology, jewellery companies are better positioned to respond to what buyers are looking for.

Jewellery manufacturers are taking advantage of this modern gold rush by offering product and design versatility as well as new platforms to view and purchase jewellery.

According to Winston Chow, director and deputy manager of Hong Kong-based Chow Sang Sang Holdings International Ltd, consumers are responding positively to novel designs that combine gold with different materials.

Meanwhile, advances in technology allow manufacturers to employ new techniques to produce a wide variety of gold jewellery. This, in turn, gives customers multiple options, depending on their personal taste, gold weight preference and price points.

The glimmer of gold

China and India remain the biggest consumers of gold jewellery, specifically those with higher gold content, revealed Chow.

According to the World Gold Council’s Gold Demand Trends 2024, while China and India recorded a decrease in gold jewellery demand in 2024 of 24 per cent and 2 per cent, respectively, their combined gold consumption still topped those of other major jewellery markets.

A mixture of weak consumer confidence, declining income growth and surging gold prices adversely affected gold jewellery demand in China, the report said. Demand picked up in December last year ahead of the New Year and Spring Festivals, but the council remained pessimistic, given China’s slowing economy, and the shift towards lighter-weight items.

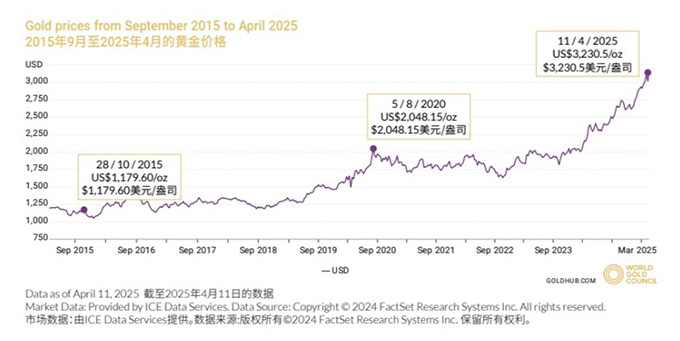

The allure of gold as a beloved adornment and store of wealth, however, remains undeniable. Chow explained that with unpredictability in the stock market, real estate and forex, many are turning to gold as a significant asset to hedge against uncertainties.

During such periods of instability, companies often allude to an M-shaped consumption pattern where affluent buyers continue to purchase jewellery while the rest either spend less or stop purchasing all together. The hardest hit are middle-income earners, particularly in Greater China.

Hence, the need to offer a broader range of products to meet the varying needs of buyers, noted Chow.

Legacy

Malaysia, for instance, continues to see strong affinity for 22-karat gold but it is also developing lightweight designs in response to evolving market demand.

According to Dato’ Chiah Hock Yew, president of the Federation of Goldsmiths and Jewellers Association of Malaysia and managing director of Jin Huo Gold & Jewellery Industries (M) Sdn Bhd, the gold market in Malaysia remains sturdy and prolific.

Citing industry data, the company official said 22-karat gold jewellery accounts for 70 to 80 per cent of the market while 24-karat gold comprises 15 to 20 per cent. Less than 5 per cent of jewellery sold in the country are gemstone and diamond pieces.

Data from Metals Focus also revealed that Malaysia produced the most gold jewellery in 2024 at 34.2 tonnes compared to other jewellery producers in Asia. By comparison, gold jewellery fabrication in Indonesia, Thailand, Vietnam and Singapore in 2024 reached 24.6t, 22.4t, 13.9t and 3.9t, respectively.

Chiah said there are approximately 4,000 gold shops nationwide while Penang has the highest number of gold jewellery manufacturing facilities in the country.

Malaysia uses both traditional and innovative manufacturing techniques such as CNC and laser engraving, and 3D printing to create diverse designs that incorporate Chinese, Malay and Indian aesthetics.

“We are also developing lightweight designs, matching jewellery sets and personalised jewellery items to align with market trends,” he noted.

Gary Karabulut, export manager at Turkish gold chain specialist Mioro, also attested to increasing demand for more delicate pieces with less gold. What is selling now are uniquely designed, electroformed hollow chains like bracelets and necklaces, he noted.

The Gemological Institute of America defines electroforming as a method of adding a thick gold plating, sometimes as thick as 200 microns, to a wax, resin, ceramic, or organic material base.

This year, Mioro unveiled electroformed gold jewellery sets inspired by motifs such as the Year of the Snake to attract Chinese customers. Karabulut said price-conscious buyers are on the lookout for lighter but sophisticated-looking items.

Technology

According to Chow, manufacturing technology, specifically for pure gold jewellery, has improved a great deal over the years.

Alloying is a popular method to produce hardened gold. “With hardened gold, we can create more intricate designs. Another critical development is hardened gold plus electroforming. Electroformed pieces can be made bigger but remain light,” explained Chow.

Recently, 3D and UV printing in gold jewellery has become more prevalent. For instance, Chow Sang Sang utilised 3D printing technology to create intricate gold thread and weave patterns for its “The Oriental” 999.9 gold bangle from its Cultural Blessings Collection.

The Charme Collection, meanwhile, offers an expansive set of charms, including diamond charms that combine gold electroforming with the jeweller’s micro diamond-setting technique and themed charms using Murano glass beads and other unconventional materials.

“These goods sell for about US$200. It is all the rage among the younger generation,” shared Chow. “Interesting designs using Murano glass together with pure hollow gold are ideal for dinners and are well loved by lady executives.”

With the advent of technology, digitalisation has played an even bigger role in companies’ sales and marketing initiatives. An omnichannel strategy combining a physical shop, e-commerce and social media is proving critical to engaging existing clients and finding new ones.

Chow said, “These interlinked channels help us target our customers with the right kind of promotion, products and price points.”

Malaysia is likewise seeing increased multiplatform engagement with buyers in line with shifting consumer trends and behaviours. According to Chiah, the three major retail models in the country are traditional stores, physical plus online shops and online-only sales.

Across all platforms, younger consumers seem to gravitate more toward trendy K-gold jewellery as well as affordable luxury and branded designs, added Chiah. Gold is likewise increasingly being viewed as a safe-haven asset, driving purchases of gold bars and coins.

“We also observe gold jewellery sales related to festivities and weddings. These include Chinese New Year, Hari Raya Aidilfitri and Deepavali or Diwali for Chinese, Malay and Indian customers, respectively,” explained Chiah.

Strategies

Moving forward, further gold price movements could adversely affect demand for gold jewellery. Chow explained that should prices continue to go up, customers may want to wait for a clearer direction before buying.

A price correction, meanwhile, could result in a steep decline since the gold market is already experiencing record highs. This could prove difficult for companies holding inventory as a devaluation could eat into their profit from the sales side.

“What can be done? We need to keep a healthy inventory to limit risks,” remarked Chow. “With many new products coming into the market using the latest technology and designs, items tend to have a shorter life cycle. Companies must constantly manage slow-moving goods to prevent excessive stock from piling up.”

For his part, Karabulut said it is becoming more challenging to find new clients, particularly at international trade exhibitions, and to expand the business, due to market uncertainties. The key is to focus on existing buyers for now – some of whom have been doing business with Mioro for more than 30 years, he stated.