As the dust settles after the Covid-19 pandemic, market interest in lab-grown diamonds is expected to soar, particularly among consumers who now pay greater attention to the sustainability credentials of the products and brands they patronise.

This article first appeared in the JNA Lab-Grown Diamond Special 2023.

By all accounts, consumer demand for lab-grown diamonds and jewellery is on an upward trajectory, driven mainly by their sustainability narrative, relative affordability and enhanced presence on the international stage, among others.

The category is steadily developing its own niche in the gem and jewellery market, particularly in the US where demand is currently greatest.

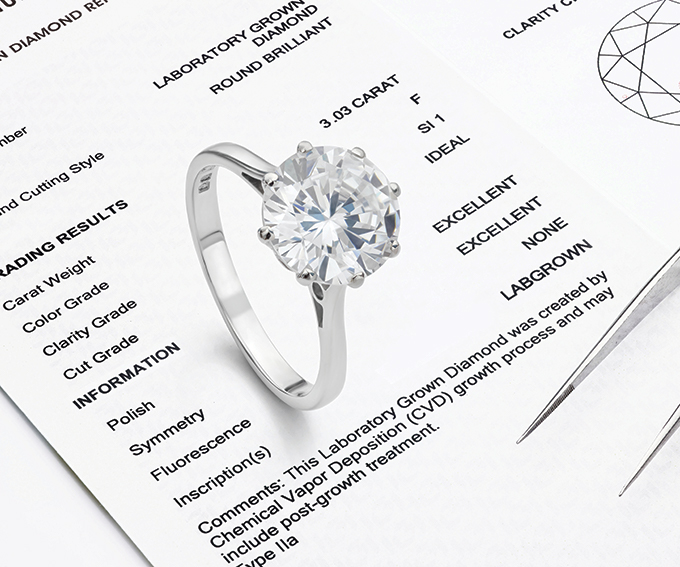

According to market analytics firm Tenoris, consumers are showing a greater appetite for larger lab-grown diamonds. The April 2023 Tenoris report by diamond industry analyst Edahn Golan stated, “Over the last few years, especially since the Covid lockdowns, consumers’ lab-grown diamond purchases gravitated away from the traditional. At present, they are preferring higher colours and clarities, but even more so towards larger lab-grown diamonds.”

Tenoris data indicated that US lab-grown diamond jewellery sales in March 2023 went up 57.6 per cent year-on-year in terms of units and 37.2 per cent in terms of value.

“In March, there was a rise in lab-grown diamond inventory, up 5 per cent. Retailers not only seem to maintain greater confidence in lab-grown diamonds, but they are also realigning their purchases to their expected sells,” Golan said in the report, noting that the share of oval-shaped

lab-grown diamonds is consistently rising, at the expense of rounds.

Average retail price also increased by 2.4 per cent month-on-month. Golan attributed this to the rise in demand and memo supply as well as the shift to larger lab-grown diamonds. The average size of loose

lab-grown diamonds sold rose from 1.79 carats in February to 1.82 carats in March. Sales of larger lab-grown diamonds – notably in the 4- and 5-carat range – are on the rise.

According to Golan, the day will come when majority of loose diamonds sold by US specialty retailers will be lab-grown diamonds. He remarked, “At this pace, this will happen within a few months and before the year-end.”

Jewellery consultancy firm The MVEye also noted growing acceptance of lab-grown diamonds among US consumers.

In its research on US-based consumers’ gifting preferences for Valentine’s Day 2023, it noted that 25 per cent of respondents intended to give fine jewellery as a gift. Almost all the jewellery would have gemstones, with 38 per cent opting for mined diamonds and 16 per cent for lab-grown diamonds. In this group, a larger percentage of women, at 28 per cent, chose lab-grown diamonds versus 8 per cent of men.

“Many women see lab-grown diamond as their jewellery of choice for gifts,” said Liz Chatelain, president of The MVEye. “The wide assortment and price points have given them greater opportunity to give fine jewellery in recent years.”

Brand activities

Greater mainstream presence of lab-grown diamonds is also giving the category a healthy boost.

Pandora caused quite a stir in 2021 when it announced its shift to lab-grown diamonds in grand fashion. Soon after, it released its Pandora Brilliance collection of lab-grown diamond jewellery in the UK.

The brand deepened its commitment to the cause in August 2022 with the launch of its Diamonds by Pandora category of lab-grown diamond jewellery in the US and Canada. Pandora Brilliance once again headlines this range with 33 pieces comprising rings, bangles, necklaces and earrings with lab-grown diamonds of VS+ quality set in silver, yellow gold or white gold. Prices start from US$300 and each stone weighs 0.15 to 1 carat. The collection's flagship product is a 1-carat lab-grown diamond set in a 14-karat gold ring.

Pandora Brilliance is also the brand’s first collection produced with 100 per cent recycled silver and gold. This aligns with the company’s pledge to produce all its jewellery with recycled silver and gold by 2025.

“The future of luxury is here today. Lab-created diamonds are just as beautiful as mined diamonds but available to more people and with lower carbon emissions. We are proud to broaden the diamond market and offer innovative jewellery that sets a new standard for how the industry can reduce its impact on the planet,” said Pandora CEO Alexander Lacik.

Lab-grown diamonds also serve as an effective vehicle for brand revivals, with storied jewellery houses reentering the scene with lab-grown diamond collections that still remain true to their design legacies.

French brand Vever, founded in 1821, relaunched in 2021 after 40 years of dormancy with trendy jewellery in recycled gold with lab-grown diamonds. The pieces also pay tribute to the plique-à-jour enamelling technique on which the jewellery house was built. Meanwhile, the patented techniques of famed French luxury jeweller Oscar Massin are likewise revived in the brand’s new incarnation launched in 2021.

Awareness and acceptance

Celebrity endorsements further solidify lab-grown diamonds’ appeal in the market.

At this year’s Met Gala themed “Karl Lagerfeld: A Line of Beauty” on May 1, supermodel Gigi Hadid shone the spotlight on lab-grown diamonds when she wore jewellery by New York-based Smiling Rocks. The "Dream Necklace" has 54 pieces of round and emerald-cut lab-grown diamonds weighing a total of 74.65 carats, including a 6-carat centre piece, set in 14-karat gold. She paired this with the brand’s High Jewelry ring with 7.70 carats of marquise, round and cushion-cut lab-grown diamonds set in 14-karat gold.

Lab-grown diamond brands also take a leading role in educating the market on their products. Smiling Rocks CEO Zulu Ghevriya recently served as guest lecturer at the London Business School’s Luxury Strategy course to share his insights on the past, present and future of the lab-grown diamond industry. Entitled “Protection vs. Disruption,” the presentation covered the science, sustainability, marketability, appeal and branding of lab-grown diamonds, among others.

Efforts at education and marketing on a sectoral level are undertaken by industry organisations such as the International Grown Diamond Association (IGDA).

Joanna Park-Tonks, founder of jewellery brand Chelsea Rocks – Laboratory Grown Diamonds, became IGDA president in the beginning of the year. Her priorities at the association include member networking, representation and the provision of actionable market insight about the lab-grown diamond industry, with the goal of making the sector more competent and organised to bestow it with a collective voice and professional community.

Park-Tonks said, “I see great value and synergies in broadening the membership base to include third-party suppliers to the lab-grown diamond industry, student members from a variety of disciplines and increasing the value proposition for retailers. We are working hard to deliver value to retailers, in particular, to provide them with tools and methodologies to explain and sell lab-grown diamonds honestly, clearly and confidently.”

The IGDA official also intends to promote a mutually respectful and equitable dialogue between the created and mined diamond industry and further enhance the luxury cachet of diamonds in general. “It is important that we maintain the status of diamonds to celebrate life’s special moments, whether as a gift or as a self-purchase. We need to guard against perceptions of value erosion throughout the whole diamond industry and maintain an aura of exclusivity, beauty and desirability. Maintaining an aspirational pricing perception for all diamonds is key to unlocking this phenomenon,” she explained.

Shining future

Industry stakeholders are also bullish on growth prospects for lab-grown diamonds this year and beyond.

Smit Virani, director of Rockrush, anticipates stronger demand in the post-pandemic era, particularly among younger consumers who value sustainability and transparency.

“Advancements in lab-grown diamond manufacturing technology are likely to continue, resulting in higher-quality and larger diamonds being produced. This could lead to more options for consumers in terms of sizes, colours and cuts,” he added.

Indeed, technological advancements are fuelling the quality and varieties of lab-grown diamonds in the market.

Bhanderi Lab Grown Diamonds Chairman Ghanshyam Bhanderi cited the significant improvements in the quality of lab-grown diamonds as a major driver of demand. “This has increased consumer confidence in the product and made lab-grown diamonds a viable alternative to mined diamonds,” he said.

Their affordable prices also work in the favour of lab-grown diamonds. Ghanshyam noted that the substantial price difference between mined and lab-grown diamonds is expected to continue in the future as lab-grown diamond production becomes more efficient and cost-effective.

Raj Vaidya, founder of Diamsparkz, agreed that the competitiveness of lab-grown diamonds was a major draw. “With natural diamond prices increasing, lab-grown diamonds have become more affordable for jewellers and end-consumers. As a result, we are confident that we will continue to grow and that consumers and jewellers will opt for lab-grown diamonds over mined diamonds due to their quality and lower prices,” he said.

According to Vaidya, lab-grown diamonds performed exceptionally well in 2022, with good sales volumes recorded for both loose diamonds and jewellery. Price corrections at the beginning of 2023 led to a slow start for Diamsparkz but he is upbeat about prospects moving forward.