New initiatives, including expanded services to the lab-grown diamond (LGD) industry, enabled Sarine Technologies Ltd to increase its group net profit by 7.2 per cent to US$1.02 million in the first half of 2024.

According to the company, strategic measures introduced in early 2024 helped generate an 11 per cent increase in recurring revenues that account for 70 per cent of overall revenue. This helped offset a drop in capital equipment revenue caused by challenging conditions in the global diamond market.

Sarine’s overall revenue for the first half of 2024 was US$21.9 million, down 7.8 per cent from the corresponding period in 2023.

Revenues from LGD-related services, however, grew significantly and is likely to account for 15 to 20 per cent of annual revenues by year’s end, the company disclosed.

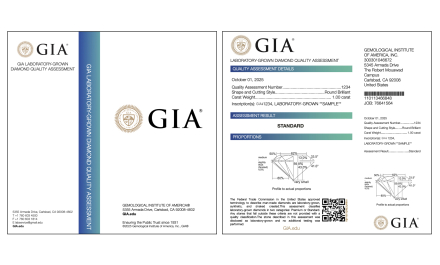

One key initiative was a new GCAL by Sarine lab in Surat, India to serve the rapidly expanding LGD industry. The new lab provides convenient, on-site services to Indian manufacturers as a more cost-effective grading solution. “We are already working with new US retail customers through their Indian suppliers and expect to further expand our grading services,” Sarine said.

Adapting its rough diamond planning technologies to LGDs also helped the business. “LGD rough planning services have experienced a rapid pace of adoption that exceeded expectations. We will continue to expand this service to generate a new stream of recurring revenues,” it continued.

Sarine however noted that the LGD sector was experiencing rapidly and sharply declining wholesale and retail prices due to substantial inventory accumulation in India and intensifying competition, leading to a distinct bifurcation between the natural and LGD retail segments.

“With much lower absolute profits generated from sharply declining retail prices, there are indications of a renewed focus on natural diamonds among many US retailers to maximise profitability and sustain viability. We expect this renewed focus to rekindle demand for rough natural diamonds and promote the anticipated equilibrium between the two segments,” the company added.

Other significant measures that have helped Sarine attract new customers are the introduction of its Most Valuable Plan for optimising the planning of small natural rough diamonds and the launch of the AutoScan™ Plus and Sarine Diamond Journey™ solutions to address ESG concerns and G7 sanctions on Russian diamonds.