Australia’s Lucapa Diamond Co Ltd has completed the sale of its majority stake in Mothae kimberlite mine in Lesotho, the company announced recently.

The divestment, conducted via a public process, follows a strategic review of Lucapa’s asset portfolio, revealed Lucapa Managing Director and CEO Nick Selby. Lucapa owned 70 per cent of Mothae while the government of Lesotho controls the other 30 per cent. The shares were sold to local Lesotho company Lephema Executive Transport (Pty) Ltd.

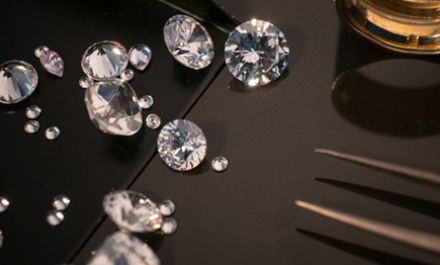

Mothae is an open-cast mine in the Maluti Mountains of Lesotho. It began commercial operations in 2019 and is known to produce large, high-value diamonds that command the second-highest dollar per carat for kimberlite diamonds worldwide, according to Lucapa.

Stuart Brown, chairman of Lucapa, was previously quoted as saying that the company wanted to streamline its portfolio to focus on core assets in Africa and Australia.

Lucapa said more than 6.1 million tonnes of ore were mined and processed and over 150,000 carats were recovered during six years of production at the mine. Total revenues reached above US$100 million.

In addition, Lucapa unearthed 13 +100-carat diamonds, the largest of which was a Type IIA gem-quality rough of 213 carats, from Mothae. Out of these, 10 diamonds were valued higher than US$1 million.

The mine has also produced several fancy colour diamonds, including a 38-carat fancy intense yellow rough alongside pink and blue diamonds.