Luxury conglomerate Richemont’s jewellery business grew by 3 per cent during the fiscal year ending March 31, 2021, driven by double-digit sales increases in Asia Pacific, the Middle East and Africa.

According to the group, jewellery sales exceeded pre-Covid levels, demonstrating the continued strength of high jewellers Cartier and Van Cleef & Arpels amid a pandemic.

In the fourth quarter of the financial year, jewellery houses saw a 54 per cent improvement in sales.

“The enduring appeal of Cartier, Van Cleef & Arpels and Buccellati led to a significant rebound in sales from the low points in April and May 2020, when more than 50 per cent of the maisons’ network was closed,” the group reported.

Overall, jewellery sales reached €7.46 billion (around US$9.12 billion) during the period in review from €7.22 billion (around US$8.83 billion) in 2020. Online retail meanwhile recorded triple-digit growth, fuelled by the jewellery and watch businesses.

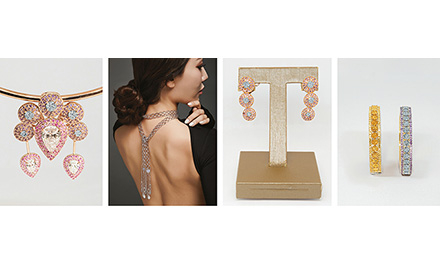

Cartier, Van Cleef & Arpels and Buccellati offered fresh variations of their iconic pieces, including Clash Supple and Santos for Cartier, Frivole and Perlée for Van Cleef & Arpels and Opera Tulle for Buccellati.

The jewellers also invested in client-centric digital initiatives and selective store renovations – Cartier renovated the Dubai Mall and Paris Saint Honoré boutiques while Van Cleef & Arpels opened new flagship stores on Tmall Luxury Pavilion and at Wuxi Center 66 in mainland China. Buccellati expanded internationally with seven new shops.

“Following a sharp decline in the first half of the financial year as the health crisis spread across the globe, sales recovered throughout the year and reached €13.14 billion (around US$16.38 billion), led by the jewellery maisons, online retail and Asia Pacific,” explained Richemont. “Strong sales in Asia Pacific, the Middle East and Africa more than compensated for lower sales in the other regions.”

Covid-19 however remains a concern. According to Richemont Chairman Johann Rupert, volatility and low visibility are likely to prevail until herd immunity is achieved amid global vaccination programmes.

“There are still concerning Covid-19 developments in parts of the world that could slow down a global recovery, even though underlying demand seems strong with supportive central bank actions, substantial government stimulus packages, and real estate and stock markets at all-time highs. We will need to learn how to live with the virus probably for much longer than we had hoped,” added Rupert.