The outlook is rosy for China’s jewellery retailers who utilise craftsmanship, effective marketing strategies and technological innovations to entice consumers amid challenging times.

This article first appeared in the JNA May/June 2025 issue.

The Chinese jewellery market is navigating a complex landscape. While demand for jewellery has softened due to economic uncertainties and historically high gold prices, domestic gold jewellery spending remains somewhat resilient. Jewellery retailers are adjusting to meet consumer preferences, ensuring that gold jewellery remains a valuable commodity in the country.

According to the 2024 China Jewellery Industry Development Report by the Gems and Jewelry Trade Association of China (GAC), the country’s gold, silver and jewellery retail sales in 2024 amounted to RMB330 billion (around US$45.4 billion), down 3.1 per cent year on year. Gold jewellery remains a top category, accounting for 73 per cent of total jewellery sales in China.

Despite the industry’s lacklustre performance last year, it started 2025 on a positive note, with seasonal factors such as the Chinese New Year supporting sales. Data from the National Statistics Bureau of China showed that sales of gold, silver and jewellery reached RMB75.5 billion (around US$10.4 billion) in January and February 2025, up 5.4 per cent year on year.

Prominent mainland retailers CHJ Jewellery and Beijing Caishikou Department Store Co Ltd sat down with JNA to talk about bright spots and challenges in the Chinese jewellery retail market.

CHJ Jewellery: Innovative marketing and overseas expansion

Founded in 1997, CHJ Jewellery positions itself as a modern jewellery retail brand, which is known for its contemporary Oriental designs, specifically filigree pieces, crafted using traditional Chinese goldsmithing techniques. Its brand philosophy resonates particularly well with younger generations seeking culture-inspired jewellery.

Chrisyta Lin, branding director of CHJ, explained, “Filigree inlay art is a national and cultural heritage that we aim to preserve. With our dedicated filigree inlay studio, we promote the fusion of filigree inlay art and modern jewellery design to ultimately make these pieces an everyday wear for younger consumers.”

The brand’s core product portfolio includes the Filigree Collection, featuring the Filigree Perfect, Filigree Ruyi, Filigree Wind and Rain Bridge lines; the Pure Gold and Diamonds Collection; and the Flourish Buddhist Collection. In 2024, these collections achieved RMB5 billion (around US$688 million) in sales, Lin added.

“CHJ continuously innovates while paying tribute to tradition. By integrating filigree inlay art with modern designs, we discovered a new growth opportunity. The concept of ‘innovation as the core, craftsmanship as the essence’ has enabled CHJ to strengthen its fundamental competitiveness in product development,” Lin commented.

Branding also remains a top priority for the company. With the implementation of an omnichannel marketing strategy a few years ago, CHJ was able to expand its digital reach. Lin said online and offline consumers exhibit varying consumption habits and preferences, hence the company employs diverse tactics tailored to their specific needs.

Brands must also meet consumers’ desire for quality and exceptional jewellery pieces through novel designs and personalised services.

For instance, gold is transforming from a traditional symbol of affluence and wealth preservation tool in China to a carrier of emotions as the trend toward meaningful purchases gains momentum.

CHJ focuses on building an emotional connection between the brand and consumers through content marketing, particularly on Xiaohongshu, revealed Lin. Several of its marketing campaigns have garnered industry acclaim, earning prestigious awards at the China Content Marketing Awards in 2024.

Lin said, “The number of Xiaohongshu users expressing interest in CHJ Jewellery has increased by 213 per cent year on year in 2025. This substantial rise indicates a notable boost in brand awareness among a younger demographic. The social platform has emerged as a vital channel for us to engage with young consumers.”

CHJ has over 1,500 stores spanning 220 cities in China. Moving forward, CHJ will continue to expand its retail footprint in overseas markets to bolster growth. The company opened new stores in Malaysia in 2024, marking its initial venture into overseas markets. It has since opened stores in Thailand and Cambodia.

“Southeast Asia shares a kind of cultural affinity with China and presents promising potential in the jewellery market,” said Lin. “We have strategically positioned ourselves in prime locations within core business districts in the region. We currently see positive performance in sales and operations in our overseas stores, meeting our expectations. Sales are showing an upward trajectory, further boosting our confidence in these markets.”

The company will focus on Southeast Asia over the next two years to drive business growth, she noted, adding that its medium- to long-term strategy is to maintain a strong presence in Southeast Asia while gradually expanding into other continents.

Caibai Jewellery: Enhancing customer experience

Beijing Caishikou Department Store Co Ltd, better known as Caibai Jewellery, is a pioneer in China’s gold jewellery industry. The company operates over 100 directly managed stores including its flagship store in Beijing and locations across Beijing, Tianjin, Hebei, Baotou, Xi'an, Suzhou and Wuhan.

For decades, Caibai Jewellery has been synonymous with professional gold jewellery services in China. It adopts a consumer-centric approach with a focus on exceptional customer service to build loyalty and brand reputation.

Ning Caigang, general manager of Beijing Caishikou Department Store Co Ltd, said, “We constantly optimise our services to adapt to evolving customer demands. Our mission is to be ‘everyone’s gold and jewellery consultant’ and to ensure that our customers enjoy quality service and premium products.”

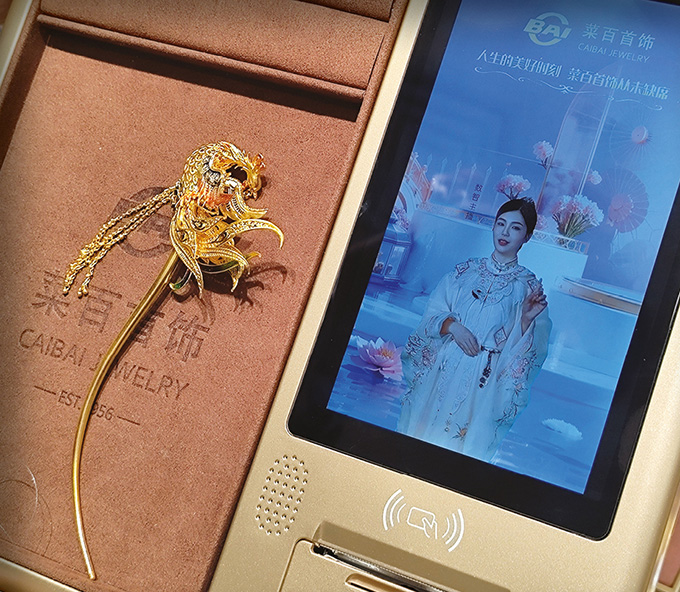

Caibai Jewellery continues to embrace technological advancements as one of its key business strategies. For instance, the company offers the smart serving tray and the smart vending machine, both aimed at enhancing the purchasing experience and providing a more convenient, secure and efficient way of buying jewellery.

Caibai Jewellery obtained patents and software copyright for these gadgets. Customers can place a jewellery product on the smart serving tray, which then displays product details on a screen. It likewise supports digital payments, thereby improving efficiency. For its part, the smart vending machine enables customers to select and purchase jewellery items via a touchscreen interface.

“These digital transformations also help streamline store operations and provide valuable support for accurate market analysis through data collection,” Ning said.

Meanwhile, Ning observed a growing sense of pride among younger Chinese consumers regarding tradition and culture. There is also an increasing preference for “self-reward purchases” as well as jewellery pieces with cultural significance and Intellectual Property (IP) products.

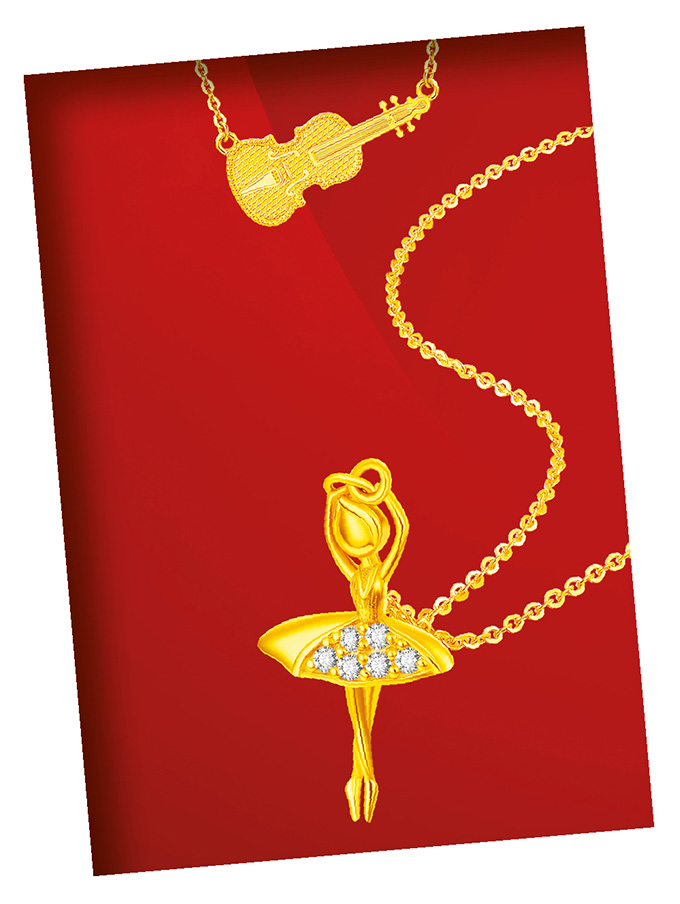

As such, Caibai Jewellery has introduced culture-themed products, especially 5G and 5D gold jewellery, to satisfy consumer appetite for trendy designs. 5G and 5D hard gold are lighter and more durable than traditional gold; they are also more suitable for gem-setting.

The company also collaborates with institutions such as the Summer Palace, the Temple of Heaven and the Capital Museum, among others, to launch special collections infused with cultural elements.

“As a well-established Chinese enterprise, we are dedicated to preserving and celebrating Chinese culture through our gold jewellery offerings,” Ning said. “For instance, we develop innovative designs that integrate the cultural essence of the ancient capital, Beijing. We ensure that our gold jewellery pays homage to China’s rich cultural heritage.”

Commenting on the impact of soaring gold prices, Ning noted that when under such circumstances, consumers tend to focus on investment products, and some would adopt a more cautious approach towards buying

gold jewellery.

Gold prices, however, are not the sole factor influencing consumers' purchasing decisions. They also consider other aspects such as craftsmanship, design and symbolism,

he added.

“Consumer demand will gradually rebound in the long term, supported by government-led policies to boost consumption,” remarked Ning.