Color Jewels Inc offers an expansive selection of premium-quality coloured gemstones that consistently captivate buyers worldwide amid supply constraints and macroeconomic woes.

This article first appeared in the GEMSWORLD 2024.

The enduring allure of high-end gems alongside rising consumer awareness and education on gem origins, characteristics and certifications are likely to fuel steady market demand in 2024 onwards.

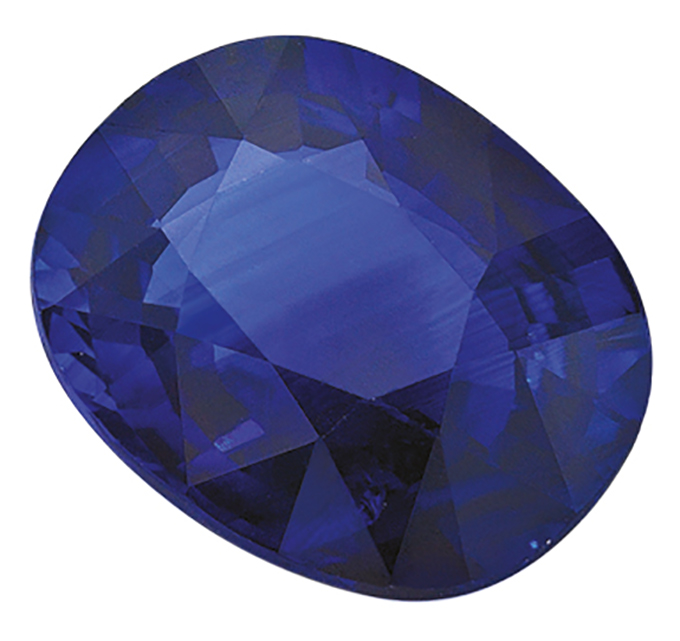

Perennial favourites rubies, sapphires and emeralds, which are already enjoying a strong following in the trade, will continue to lead the growth, according to Color Jewels Inc CEO Ashish Dangayach.

“These are the best-performing gems for us,” he noted. “Nowadays, origin and certification are keys to making a sale. People are on the lookout for Burmese rubies, specifically from Mogok, as well as Kashmir, Burmese and Sri Lankan sapphires. Meanwhile, Colombian emeralds remain highly sought after.”

Color Jewels’ top markets are Asia and Europe. Its buyers favour coloured gemstones of 8 carats to 20 carats while the most requested cuts for rubies and sapphires are antique, cushion, oval and traditional; and emerald cut for emeralds, added Dangayach.

Investment gems

Luxury rubies, sapphires and emeralds are easier to sell as they speak for themselves in terms of beauty, quality and investment value. These gems, however, have become harder to come by due to dwindling supply in Colombia and Myanmar (formerly Burma), where celebrated gemstone mines are located.

Meanwhile, prices are up 50 per cent to 100 per cent from pre-Covid levels, signalling solid buyer interest in coloured gems. Take, for instance, a top-range Burmese sapphire of 5 carats to 10 carats. Dangayach said that a gem of this quality sells for US$15,000 to US$20,000 a carat as of end-2023 compared to US$10,000 per carat three or four years earlier.

This upward trend in prices is expected to continue amid rising demand and limited stocks. The company official explained, “There are more people wanting to own and invest in these coveted gems compared to 10 to 15 years prior, so demand outweighs what is in the market now.”

Perceptive buyers

The level of consumer education is also unprecedented, according to Dangayach. Even end-buyers now have greater knowledge of gemstone origins, certifications and enhancements, among others, helping them make informed purchasing decisions. This was not the case around a decade ago.

“Customers have become more educated about important factors that, in the past, only people in the trade know. Overall, the market has become more discerning,” the company official added.

Moving forward, buyer interest in premium gems could further strengthen in 2024, with pink and Padparadscha sapphires, Paraiba tourmalines from Mozambique and Mahenge spinels as prospective superstars in the trade.

Major jewellery brands and designers are already using these in their latest collections, which only adds to the gems’ exceptional charm and saleability, noted Dangayach.

Global challenges, however, could hinder consumer spending throughout the first half of 2024. According to him, people are spending less, and the luxury sector – the gem and jewellery sector included – is bearing the brunt of such austerity measures. The trade is not seeing the same level of demand as it did pre-Covid, he added.

“It will take time for the market to stabilise. People tend to spend more on luxury items when the economy is doing well, so we just need to wait for the global economy to improve and the luxury sector will follow suit," he said. "The good news is coloured gems will continue to be viable investment alternatives during challenging times.”