China has high hopes for the jewellery trade in 2024 – the Year of the Dragon based on the Chinese calendar – but any progress will depend primarily on the country’s economic recovery. Industry players expect the gold and pearl sectors to continue their upward trajectory, with demand for coloured gemstones gaining ground and the diamond trade finding a foothold after a slow post-pandemic start.

This article first appeared in the JNA January/February 2024 issue.

As one of the largest jewellery manufacturers and consumers around the world, China remains a force to reckon with in the global jewellery sector.

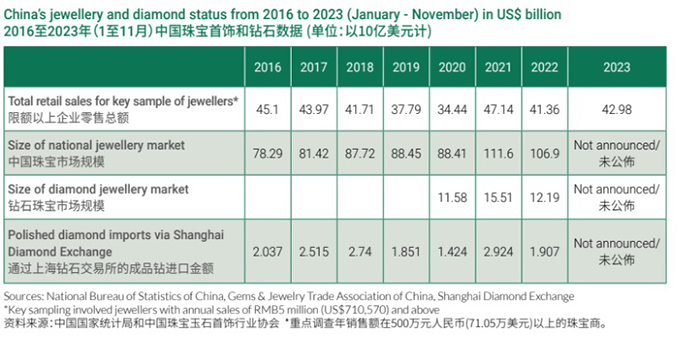

Data from China’s Jewellery Market Development Report, snippets of which were shared by Gems & Jewelry Trade Association of China (GAC) Vice President and Secretary-General Bi Lijun at the 2023 Global Gems and Jewellery Development Conference in Hainan Province in November 2023, showed that China’s jewellery industry had reached RMB719 billion (around US$106 billion) in 2022 from RMB580 billion (approximately US$87 billion) in 2018, demonstrating an average annual growth rate of 5.5 per cent.

As of 2022, the market share of gold, jade, diamond, coloured gemstone and pearl jewellery accounted for 57 per cent, 21 per cent, 11 per cent, 4 per cent and 3 per cent, respectively. Specifically, China's gold consumption is enjoying a post-pandemic rebound, with a year-on-year growth of 7.32 per cent in the first three quarters of 2023.

Meanwhile, diamonds are experiencing cyclical fluctuations, with the market size falling 18 per cent year on year in 2022.

On a more promising note, the jade market (including jadeite and nephrite) is expanding rapidly, with market size growing 145 per cent in 2022 compared to 2019.

The report also said Chinese jewellery imports in the past five years reflected a “V-shaped” rebound pattern with the year 2020 as a low point while exceeding pre-pandemic levels in 2022. In the first three quarters of 2023, jewellery imports amounted to US$87.86 billion, an increase of 22.5 per cent from year-ago figures.

Gold’s ‘dragon’ status

According to Roland Wang, managing director of World Gold Council (WGC) China, domestic demand for gold remained strong in 2023 despite record-high gold prices and economic uncertainties.

Against a challenging backdrop, gold remains one of the best-performing assets, thanks to solid demand.

WGC data showed that as of November 2023, gold prices have risen by 17.08 per cent to RMB470.37 (around US$66) per gram. By comparison, prices were at RMB401.76 (about US$57) a gram in November 2022 and RMB374.54 (nearly US$53) during the same period in 2021.

The younger generation in China, including the Gen Zs, also loves gold jewellery, revealed Wang. Contemporary and intricate designs, as well as innovations in manufacturing technology to make 24-karat gold jewellery harder yet lighter in weight, are instrumental to this steady demand.

WGC data also showed that demand for gold jewellery in China reached 481 tonnes in the first three quarters of 2023, up 8 per cent year on year. Wang explained, “Gold possesses two shining attributes: A luxury commodity and an investment tool. The widespread promotion of lightweight gold jewellery products and gold as a safe-haven asset will continue to attract attention and drive demand amid geopolitical and economic headwinds. In the future, modern developments will be a new normal in China's gold jewellery industry.”

Moving forward, volatile gold prices and structural market changes could further challenge the gold market while product innovations, steady demand and buyers’ value-preservation mentality will boost market growth.

Overall, WGC expects the gold market in China to remain stable in 2024.

Wu Fenghua, founder and director of Art of TTF Haute Joaillerie, also attested to gold’s versatility and enduring beauty. He noted, “Inventive designs lend modernity to 24-karat gold jewellery, making it resonate with a wider audience. India and other South Asian countries as well as the Arab world favour 22-karat gold jewellery while Europe and the US opt for 18-karat and 14-karat gold jewellery. The Chinese, for their part, have a special connection with 24-karat gold.”

State of diamond market

The year 2023 was particularly tough for the global diamond market, China included. Diamantaires in China were eager to see recovery in prices and sales, but the business lost steam around March last year.

GAC, alongside the National Gemstone Testing Center (NGTC) and Shanghai Diamond Exchange (SDE), issued a joint statement in November last year to address challenges in the natural diamond market. Acknowledging difficulties arising from global economic downturns and industry-specific issues since 2022, the groups emphasised the value of natural diamonds, owing to their rarity and symbolic status.

It also differentiated between natural diamonds as a scarce resource, and lab-grown diamonds as mass-produced products, noting the widening price gap between the two goods. The groups also urged sellers to educate customers on these differences and pledged to collaborate globally to boost transparency and growth.

China's diamond jewellery market reached approximately US$12.2 billion in 2022, accounting for around 11 per cent of China’s jewellery market. By comparison, diamond jewellery makes up 26 per cent of the global jewellery market, which means there is still room for further growth.

Yoram Dvash, president of the World Federation of Diamond Bourses (WFDB), said China did not emerge from the pandemic as expected, and this was true across the board, not only for diamonds.

He continued, “China is still coping with slow economic growth due to Covid-19. On the other hand, we strongly hope and believe that we will see a turning point at the March Hong Kong show in 2024, with a solid turnout of Chinese buyers and demand for polished natural diamonds. We expect the massive advertising campaign that De Beers has launched in the US and Chinese markets to bolster demand.”

Winny Chun, chairman of diamond jewellery retailer Shining House, said high-value collections and investment-grade diamonds are expected to move fast in 2024 while the market for bridal and mid- and commercial-range diamond jewellery needs further firming up.

She also underscored the significance of diversification through offering a wider array of products and implementing new business models. Shining House has nearly 500 points of sale across China.

Pearl prospects

China’s pearl industry – both retail and wholesale – performed strongly in 2023 compared to 2022, according to Tu Xingcai, president of Shenzhen Pearl Trade Association.

Pearl retail sales grew steadily, thanks to modern jewellery designs that cater to the artistic requirements of today’s consumers. Meanwhile, the wholesale market is likewise on the rise. “Wholesalers, recognising the potential of the market, started purchasing high-quality pearls in large quantities to meet this demand,” noted Tu.

The pearl industry also witnessed new retail trends in 2023. With online shopping becoming trendy, pearls are increasingly being sold through e-commerce platforms, providing consumers with more choices and greater convenience. Personalised customisation is also an emerging trend in the retail market, allowing consumers to choose the shape, colour and size of the pearls, as well as the unique, individual designs of their jewellery.

Price increases for high-quality pearls in 2023 were due to a drop in pearl production amid higher consumer demand. However, Tu said this will not affect future sales as desire for premium pearls remains robust.

China’s pearl sector is also eyeing a more dynamic 2024. According to Tu, measures such as organising jewellery exhibitions, collaborating with designers, and strengthening promotions on social media platforms could further contribute to the sector’s growth. Personalised customisation, online sales and a focus on sustainability are also seen to flourish in 2024.

Potential of coloured gems

The gemstone market in China was in a longer period of remission compared to other markets, so the rebound will be more pronounced, explained Damien Cody, president of the International Colored Gemstone Association (ICA).

Lu Ying, founder and designer of Shanghai-based Privaguet Jewelry commented, “We expect sustained growth and increased consumer discernment in 2024. Consumers are showing interest in unique gemstones like ruby, sapphire, emerald and Paraiba tourmaline. The dwindling supply of rare coloured gemstones, meanwhile, further raises their investment value, making them attractive to investors seeking to diversify their portfolios.”

There is likewise growing consumer consciousness about the origin of gemstones. Sustainability, environmental-friendly sourcing, and ethical processing will be critical factors in the market, Lu added.

Consumers' focus on personalisation and innovative designs is spurring demand for more creative coloured gemstone jewellery pieces. As such, designers and brands will need to introduce trendier products to cater to diverse consumer needs.

Growth, however, could be slow for the coloured gemstone market in 2024, but things are expected to turn around in June when consumption begins to improve. There will also be a greater emphasis on sustainability, product quality and design innovation. Companies must stay attuned to market trends and evolving consumer demand, added Lu.