Relatively new to China, fancy colour diamonds are emerging as a promising niche segment as discerning mainland consumers steadily progress from entry-point yellows to the full spectrum of colours.

This article first appeared in the JNA November/December 2023 issue.

Fancy colour diamonds had a relatively late start in China. Interest started sprouting in the early 2010s, nearly two decades after the development of the diamond market in the country, and gained steam from 2015.

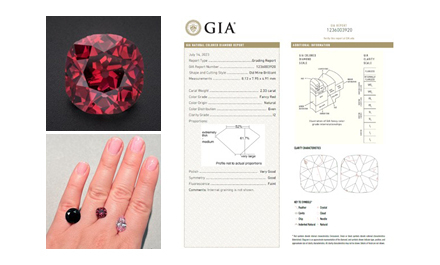

According to the China Diamond Market Analysis Report 2022 by the National Gems & Jewelry Testing Group (Shanghai) Co Ltd (NGTC), stones on the D-Z colour scale accounted for 98 per cent of the diamonds submitted to its gem testing laboratories in China. Yellow and other fancy colour diamonds only constitute 1 per cent of the total. In China’s fancy colour diamond market, yellows move well due mainly to their relatively lower per-carat price, often making them consumers’ first fancy colour diamond purchase. Bigger yellow diamonds are also more affordable and easily available, compared to pinks, blues and reds.

“Yellow is a popular colour among consumers as it signifies wealth in Chinese culture. Yellow diamonds have been a major icebreaker and growth driver in China's fancy colour diamond market in recent years, powering greater demand for other colours,” said Chen Zuwei, president of Rosy Clouds Colored Diamonds, which specialises in rare and top-quality fancy colour diamonds.

Chen noted that interest in pink, blue, green, orange and even purple and red diamonds is now growing throughout the country, and the entire market for fancy colour diamonds is expanding rapidly.

Also fuelling demand is the concept of rare, valuable and top-grade fancy colour diamonds as a tangible and durable store of wealth for high-net-worth individuals as well as their suitability for investment and generational wealth.

According to Chen, the Chinese market views fancy colour diamonds far more favourably than their colourless counterparts. "White diamonds' retention value has been eroding in many consumers’ eyes as these are increasingly seen as regular, daily-wear products. Chinese high-net-worth individuals, however, view fancy colour diamonds as valuable assets and collector’s items. These are purchased not only for personal use but also as an alternative store of family wealth, a highly valued collectible or an investment to hedge against inflation,” Chen explained.

Market preferences

Alon Blik, regional director of Scarselli, has observed different levels of maturity in the China market when it comes to fancy colour diamonds.

“Thankfully, today, we have customers that understand the importance of quality versus price. Some customers only look at the certificate and the 4Cs and simply want the best price based on that. Others look at the beauty of the diamond: The level of intensity of the colour or the uniqueness of the shape. And then, there are those who combine the two standards and keep an eye on the investment value or resale value of the diamond,”

revealed Blik.

Li Shiqi, president of Ming Qi Jewelry, said buying fancy colour diamonds comes with a learning curve for Chinese consumers. He remarked, “In the early days, they favoured bigger and less expensive fancy colour diamonds. With the market becoming more mature, customers no longer pursue carat size and now prefer diamonds with higher colour saturation.”

Chinese consumers also pay greater attention to the resale value and appreciation of the fancy colour diamonds they buy, noted Chen of Rosy Clouds. The country’s high-net-worth individuals therefore gravitate towards high-quality stones with good value prospects such as reds, blues, pinks, oranges, greens and purples.

While blue, pink and yellow diamonds are currently the most favoured in China, regional preferences exist, Chen continued. “In the northern regions, consumers are more inclined to buy big fancy colour diamonds and are less stringent about colour and clarity. They can accept stones with a lighter colour or secondary hues. Consumers in southern areas such as Shanghai, Shenzhen, Yangtze River Delta and Pearl River Delta cities are more particular about the quality of the diamonds and seek top colours. Smaller sizes are acceptable so long as the colour is exceptional,” he shared.

Level of specialisation

China’s fancy colour diamond market also comes with a high bar for the trade. Grading and trading in this field requires specialised knowledge and skills as well as higher capital requirements than the white diamond business.

Li of Ming Qi Jewelry remarked that fancy colour diamonds are graded and rated differently, with its own set of colour ranges. Prices are also less straightforward than colourless diamonds, with various factors such as colour and rarity coming into play. Prices therefore cannot be assessed solely from the grading report. Instead, the diamond has to be viewed personally to ascertain the nuance of colour and quality.

In addition, capital requirements are exorbitantly high since high-end fancy colour diamonds, especially top-colour stones, are extremely valuable, Chen commented. As per-carat prices of red, blue and pink diamonds can often be a hundred times more than that of colourless diamonds, most merchants are unable to operate in the field. The few who do survive and thrive in China’s fancy colour diamond sector are thus experts and trustworthy specialists, he said.

Evaluating the quality and prices of fancy colour diamonds likewise requires a specific set of skills, Chen noted. Unlike white diamonds that are relatively homogenous and can be priced on a standardised and transparent system, prices of fancy colour diamonds depend on various factors, including colour and rarity.

Some categories such as reds, purples, violets, blues, pinks and oranges are extremely rare. According to Chen, there are fewer than 10 violet diamonds with full carat sizes in the world. And only 20 to 30 red diamonds over 1 carat are trading globally.

Such rarity makes it impossible to set a standardised evaluation system for fancy colour diamonds, and prices often can be determined only through records established at the big auction houses such as Sotheby’s and Christie’s, Chen disclosed.

Challenges and opportunities

Given their rarity, high prices and unique selling points, fancy colour diamonds only gained traction in China in recent years. Li of Ming Qi Jewelry thus believes the category has plenty of room to grow in the domestic luxury jewellery market. “Since fancy colour diamonds command high prices, the market curve often overlaps with the overall economic situation in the country,” he added.

Blik likewise sees endless possibilities for the category in one of the world’s biggest markets, but he cites lack of market confidence as the biggest hurdle at present.

“The challenge is convincing buyers that, even during uncertain times, buying fancy colour diamonds is a safe haven. Another issue is educating buyers on understanding how to value a fancy colour diamond and filter for themselves real, relevant information from the fake news,” he commented.

Price hikes have also tempered buyer enthusiasm. Blik noted that prices of fancy colour diamonds rose substantially from 2020 to 2022. While there was strong interest in April and May in China, customers have been hesitant to make purchases due to the new, higher prices compared to 2020 and 2021.

He stated, “Now that we are getting used to the new market reality, and coming out of the very slow summer months, I hope that the dynamic will result in more demand and sales. We can see that the consumer has more interest in fancy colours and understand that these are to be evaluated differently from white diamonds.”

Chen, for his part, said tougher competition has been trimming profit margins as fancy colour diamond dealers seek to make a sale. The market is, however, still big enough to accommodate all players, and professional top-level merchants will eventually prevail.

The Fancy Color Research Foundation (FCRF) attests to the bright prospects for fancy colour diamonds in China.

FCRF CEO Miri Chen said, “Our data suppliers and members report that the last two quarters were robust for fancy colour diamonds across all markets, with yellow fancy colour diamonds in the intense and vivid category, in all sizes, performing especially well. The Chinese market exhibited superior performance in other colours, such as pink and blue. However, we believe there is more potential for growth compared to the period before Covid.”