China’s jewellery and gemstone sector faces a tough road to real and lasting recovery, owing to soaring prices and cautious market sentiment. The country, however, is seeing solid growth in specific sectors.

This article first appeared in the JNA November/December 2023 issue.

China has seen unparalleled growth in the jewellery and gemstone sector over the last few years, but the year 2023 is proving to be quite challenging for the trade as continued increases in prices alongside muted consumer sentiment take their toll on some areas of the business.

Traditional products such as gold jewellery, however, remain highly favoured. Data from the 2022 China Jewelry Industry Development Report by the Gems & Jewelry Trade Association of China (GAC) showed that gold continues to enjoy solid demand locally, accounting for around 57 per cent of the overall jewellery market in 2022.

Gold is likely to help offset losses from diamond jewellery in 2023, according to industry experts. Demand for luxury jewellery, meanwhile, is also expected to stay strong.

Lacklustre demand

China’s diamond sector saw its market share shrink to 11 per cent in 2022 from 12.9 per cent in 2021, largely due to challenges in the midstream. In particular, companies are observing slow demand in the bridal jewellery category.

The year 2023 has been especially difficult for some diamond dealers since a great deal of major retailers opted not to place large orders – an unprecedented occurrence in 30 years.

Some traders attribute this lacklustre performance to lingering effects of the pandemic alongside economic uncertainties, declining marriage rates and the rise of lab-grown diamonds. The bridal jewellery sector, meanwhile, is leaning more towards gold jewellery.

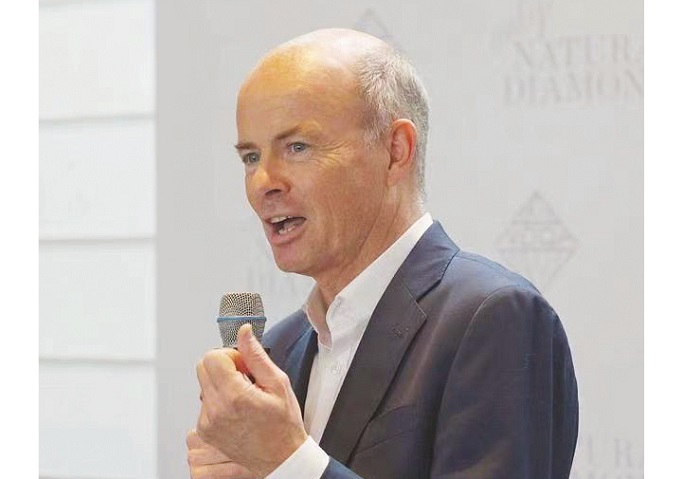

“The middle market is suffering from more cautious consumers. There is also macroeconomic instability. The cost of living has likewise increased, particularly affecting younger consumers. There has definitely been a slowdown this year,” said David Kellie, CEO of the Natural Diamond Council.

It remains to be seen whether China’s diamond market is suffering from a real slowdown or simply a sluggish pace of growth after long periods of exceptional development over the last 10 to 15 years, added Kellie.

In fact, some sectors of the trade are showing promise, especially the high-end jewellery segment. Chinese luxury jewellery brand Kimberlite Diamond recently launched its new “Nature’s Artistry” series of 24 high jewellery pieces, demonstrating its confidence in the luxury jewellery sector.

Chen Zuwei, president of Rosy Clouds Colored Diamonds, however noted that current prices of fancy colour diamonds seem “unacceptable” and could negatively affect the future of the trade.

“Our company focuses on high-quality fancy colour diamonds. We purchased collection-grade fancy colour diamonds at Jewellery & Gem WORLD Hong Kong in September 2023 and the price levels were significantly higher compared to a few months ago. We saw about 10 per cent to 15 per cent increase in prices,” revealed Chen.

Colourful prospects

The coloured gemstone market in China holds more promise as demand further strengthened in 2023 amid price increases. Coloured gemstones are rising in popularity among younger consumers and this new demand is driving strong sales and price hikes.

According to GAC Capital, a research and investment firm associated with GAC, the average price increase for all categories of coloured gemstones in China in the first half of 2023 ranged from 30 per cent to 50 per cent.

Prices of larger stones or rarer gemstones, meanwhile, rose by as much as 100 per cent to 150 per cent. The average unit price per carat of rubies and sapphires were up by about 30 per cent while that of other gems like spessartite garnet, aquamarine and morganite in niche categories climbed by 10 per cent to 30 per cent.

Traders said demand is present but many of them question the sustainability of current price levels.

“Wholesale prices are rising rapidly and consumers have yet to accept these new levels,” said Clement Sabbagh, director of Ben Sabbagh Brothers and former president of the International Color Gemstone Association (ICA).

Lu Ying, founder and designer of Shanghai-based Privaguet Jewelry, agreed, adding that China’s jewellery industry is at a new crossroads.

“As a business owner who has been operating brick-and-mortar stores for many years, I feel that the current jewellery market in China is entering a very intriguing situation,” noted Lu. “Consumer-level products, which we thought were cost-effective in the past, are no longer as easy to sell as they used to be.”

Instead, two major market developments are taking place: Top-notch products that can be considered as investments are moving faster than before while inexpensive but personalised items are gaining greater favour among younger customers.

“Change in the industry in inevitable. A number of companies may enjoy steady sales because they focus on a niche category while some may face challenges since they cannot acquire inventory at high prices and cannot sell at retail,” Lu remarked.

Further price hikes can be expected, following price increases for rubies, sapphires and emeralds. According to the company official, prices of Mahenge and jedi spinel likewise registered substantial price hikes. Other gems such as opals and some varieties of tourmaline such as lagoon tourmaline are likely to follow suit.

Lu continued, “Chinese jewellers still have strong purchasing power, especially among emerging e-commerce jewellers and those with digital and social media expertise.”

Allure of pearls

China’s pearl jewellery sector accounted for around 3 per cent of the country’s jewellery market in 2022, but it has witnessed the highest growth over the last two years. Prices, too, have escalated.

Li Tao, director of Purchasing of top retailer Keer Jewelry, said, “Prices of Akoya pearls have significantly increased in recent years, with the current price levels approximately two to three times higher than pre-pandemic times. Prices in 2023 have risen by 60 per cent.”

Prices of Tahitian and South Sea pearls have likewise skyrocketed. Traders are attributing these hikes to lower production amid growing demand in China. Younger consumers are buying more pearls as manufacturers increasingly develop more modern designs and utilise digital channels and celebrity marketing to boost sales.

Freshwater pearls are also witnessing solid demand. According to He Tieyuan, secretary general of Zhejiang Pearl Trade Association, the quality of some freshwater pearls produced in China can easily rival that of their saltwater counterparts. And they are more affordable.

China is the world’s largest producer of freshwater pearls. Shanxiahu Town in Zhuji City, Zhejiang Province, also known as the Pearl Capital of China, has the biggest freshwater pearl market, accounting for 73 per cent of global freshwater pearl production and 80 per cent of China’s freshwater pearl output.

China, however, has been producing fewer freshwater pearls as some pearl farms, which failed to meet government standards, were shut down. Data from the Zhejiang Pearl Trade Association showed that overall production of pearls in China reached 800,000 kilograms in 2021, down from 1 million in 2020 and 1.2 million in 2019.

Government data showed prices of freshwater pearls grew 30 per cent to 50 per cent in 2023. Special pearls have become even more expensive, with an 80 per cent uptick in prices.

Many pearl dealers and retailers are willing to replenish their inventories but there are also price concerns, according to industry players.