The pearl industry is witnessing unprecedented growth across all pearl varieties as well as increased market appreciation for novelty in jewellery designs. Challenges notwithstanding, pearl companies remain bullish about business prospects as global demand for the treasured gem gains further traction.

This article first appeared in the Pearl Report 2023-2024.

Pearls are the darlings of today’s jewellery industry. Symbolising organic beauty, versatility and an illustrious past, they consistently take pride of place in the luxury sector as favoured centrepieces in high jewellery collections.

Demand is also robust among a younger generation of buyers who value the pearl’s creative potential as well as men who increasingly wear the gem as a fashion statement.

This exceptional demand is pushing prices up, with traders pointing to significant price adjustments for Japanese Akoya, South Sea and Tahitian pearls from pre-Covid levels.

Supply constraints, owing to high demand coupled with oyster mortality and environmental challenges such as water temperature fluctuations, are also a concern, but several dealers and manufacturers remain confident that pearls currently in their inventory can keep the market afloat.

Pearl business

China is leading the demand upsurge for pearls while the US and Europe are also seeing solid market appetite, especially for premium-quality pearls.

According to George Kakuda, chairman of the Japan Pearl Exporters Association (JPEA), strong demand from China is driving steep price increases that buyers from other countries are struggling to accommodate.

Unit prices of Japanese Akoya pearls at auction have so far increased by more than 100 per cent to Y7,300 per momme from Y3,000 per momme in 2015 to 2020. These figures were based on results of joint sales, representing average price per momme of top- to low-quality goods.

Fine-quality, round white South Sea pearls, meanwhile, saw unit price adjustments of close to 200 per cent to Y200,000 per momme from Y70,000 per momme pre-Covid.

Sourcing has also become more challenging. Kakuda said market developments are redefining the pearl business in Japan. In the past, dealers could easily supply pearls according to customers’ exact sourcing needs and specifications whereas now, it is the other way around.

“Stocks are limited, so we had to change our strategy. Now, we present what we have to the market, with a specific price range, and ask who is interested,” the JPEA

chairman explained.

Rosario Autore, CEO and founder of Australian South Sea pearl specialist Autore, said fewer companies are producing better-quality white South Sea pearls amid increasing demand.

Asia, led by China and Japan, are prime movers in the pearl trade but demand is steadily growing in the US and Europe, too. Autore also entertains enquiries from South America and the Middle East.

Autore, which produces approximately 350,000 pearls annually in Indonesia and Australia, has seen record annual turnover and profitability in 2022 and 2023, noted Rosario. The company is also the second-largest producer and quota holder in Australia.

“Autore heavily invested in research and development over the last 13 years. The pearls we produce and sell at auction can attest to our high standards of quality,” remarked Rosario. “Based on competitive bidding at our auctions, all lots achieve prices exceeding undisclosed reserves. The only challenge we face is keeping up with demand.”

Tahitian pearls are also in the limelight, with buyers opting for round to semi-round and baroque pearls of vivid colours and exceptional lustre at auction, said Kakuda of JPEA. According to the Tahitian Pearl Association Hong Kong (TPAHK), results of its auctions in August 2023 showed that high-quality, round Tahitian pearls were extremely sought after while prices have soared significantly from pre-pandemic levels.

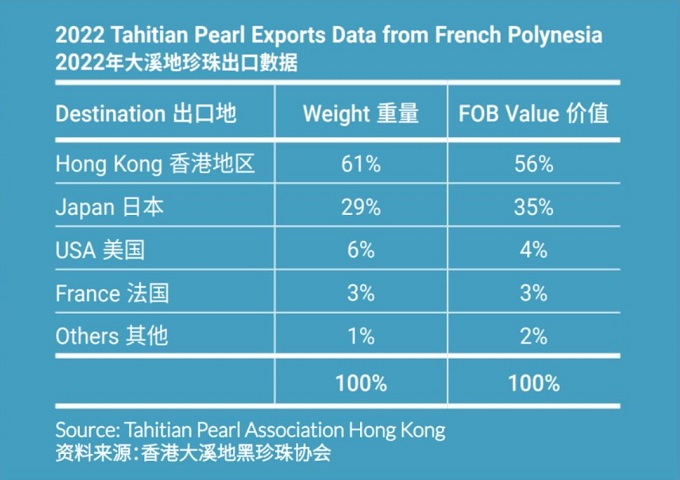

Interest in uniquely shaped pearls like keshi and semi-baroque are also on the upswing, thanks to limited production and mainland Chinese celebrities promoting these pearls. Meanwhile, Hong Kong accounted for 61 per cent of Tahitian pearl exports (by weight) from French Polynesia in 2022, TPAHK data showed. Hong Kong has retained this position since 2010.

TPAHK said prospects remain bright for Tahitian pearls throughout 2023 amid tighter supply and high prices, with Asia, the US and Europe contributing to business growth.

Jonathan Cheng, director of Rio Pearl, said what is creating extraordinary demand for all pearl varieties, including Tahitian, white and golden South Sea and Akoya pearls, is the tight supply of quality goods in the market. Several farms closed in 2021 and 2022 due to difficulties arising from Covid, leaving only the big producers to supply pearls in the market. “Demand outweighs what is in the market now. Most buyers are finding it difficult to source goods across the board,” noted Cheng. “The market, however, is relatively stable, with sizable producers still making the same number of pearls, if not slightly more.”

Design revolution

The beloved pearl is all the rage in the fine jewellery market today, thanks to innovative jewellers and discerning buyers. Jorg Gellner, CEO of German fine jeweller Gellner, said clients were actively buying big-ticket pearl jewellery items during the pandemic as funds intended for luxury travel were diverted to jewellery purchases.

For instance, the company unveiled a necklace adorned with Marutea (Tahitian) pearls from its Castaway Collection in 2022. The piece costs EUR22,000 (around US$23,700) at retail. Gellner was initially looking at offering just a few pieces for the Christmas season, but 10 necklaces were quickly snapped up within 10 days. By the end of 2022, Gellner had already sold 22 pieces.

“That was quite a success. We could not have sold that necklace at that price range three or five years ago,” noted Jorg. “We see a shift in how people buy jewellery and the kind of designs they gravitate to.”

Gellner’s bestselling Castaway Collection features elegant combinations of pearls with diamonds.

Jorg does not see a drastic drop in luxury jewellery shopping even as international travel is normalising. Jewellers may sell fewer pieces but at higher prices with better returns, which is testament to buyers’ willingness to invest in luxurious items, he explained.

There is also an emerging pearl jewellery culture among younger people aged between 20 and 35 years old. And they favour Japanese Akoya pearls. Gellner recorded a 60 per cent year-on-year jump in sales of plain Japanese Akoya pearl necklaces in 2022 alone.

The company likewise unveiled a men’s jewellery line, which was well-received in the market. Gellner specialises in South Sea, Tahitian and Japanese pearl jewellery, with major markets all over Europe.

This constant innovation in design and product offerings is key to sustaining buyers’ interest, remarked Michael Hakimian, CEO of high-end pearl jeweller Yoko London. Yoko London made substantial investments in new production techniques, technology and increasingly inventive designs while offering a broader price range encompassing entry-level jewellery pieces to exclusive, one-of-a-kind items.

The UK-based jeweller, whose main markets are the US, the Middle East, Asia and Europe, aims to produce 200 to 300 jewellery pieces a year as a way to diversify its product portfolio and appeal to a wider buyer demographic. Yoko London produced 300 new items at the height of the Covid-19 pandemic.

Hakimian said, “We found many new clients and established new partnerships with retailers around the world because of this endeavour. They like what we do and the message that our collections represent.”

Echoing industry observations, he said smaller Japanese Akoya pearls are enjoying strong demand today, thanks to their inimitable quality and affordability. These pearls, however, are also harder to come by. Yoko London has introduced a great deal of collections featuring ultra-feminine 3mm to 5mm Japanese Akoya pearls, which have become top sellers.

White South Sea pearls are also gaining further traction, specifically those sized 9mm to 12mm as opposed to larger ones, which were trendier five or six years ago. Collectors, on the other end of the spectrum, continue to source 17mm to 19mm pearls as these are classic pieces.

Yoko London’s new collection launching in September 2023 celebrates the company’s unique design philosophy of melding classic and contemporary styles. “There is always one aesthetic element that makes the designs more innovative and up to date. We call it ‘pearls with a twist.’ That is our claim to fame,” noted Hakimian.

Pearl prospects

Cheng of Rio Pearl raised the need to strengthen efforts to resonate more effectively with the younger generation and to appeal to a wider range of consumers.

“We are seeing this in China. There are also a lot of young people entering our industry as wholesalers, who in turn, can attract a younger customer base. This is good for our industry,” he noted.

Kakuda of JPEA, for his part, said the demand and supply situation could stabilise in five to six years’ time, but 2023 is projected to be a year of growth for the pearl sector, owing to soaring demand from major markets, led

by China.