As luxury brands crowd China’s Tier 1 and Tier 2 cities, jewellers increasingly train their sights on developing but equally promising areas for further growth. Home to younger consumers with growing disposable incomes, lower-tier cities accommodate further expansion and brand reinforcement in new markets that can yield the loyal customers of tomorrow.

This article first appeared in the JNA May/June 2023 issue.

China’s massive population of 1.411 billion people is arguably one of its most attractive qualities as a market. This translates to over a billion consumers or potential customers for consumer products. Luxury brands, jewellery included, usually make a beeline for China’s thriving metropolises. For the big names, it is imperative to have a presence in Beijing, Shanghai, Shenzhen and Guangzhou – the Tier 1 cities that house more than 10 million people each.

But after decades of concentrated development, jewellery markets in these bustling consumer hubs are saturated with international and local brands. As competition in Tier 1 and Tier 2 cities intensifies, growth lies in the less developed but equally promising lower-tier markets.

Over three-fourths of China’s population, 77.55 per cent to be exact, live in Tier 3 cities and below, according to the National Bureau of Statistics. Expansion in lower-tier municipalities and townships is thus of strategic importance to jewellery brands seeking further growth. Successfully navigating one’s way in this potentially lucrative terrain however requires proper product development, enhanced brand positioning, supply chain optimisation and accurate data analysis.

Expansion strategy

Why is demand for jewellery on the rise in China’s lower-tier cities? Well, their growing middle class has more disposable income than ever before, allowing them to purchase luxury items such as jewellery. In addition, the development of e-commerce and social platforms make it easier for people living in smaller towns and rural areas to buy jewellery online, making this luxury more accessible to a wider swath of the population.

Rising jewellery sales in recent years affirm lower-tier cities’ ability to drive growth. Several big chain stores rely on their local franchisees to speed up expansion, banking on the latter’s knowledge of local operations and markets.

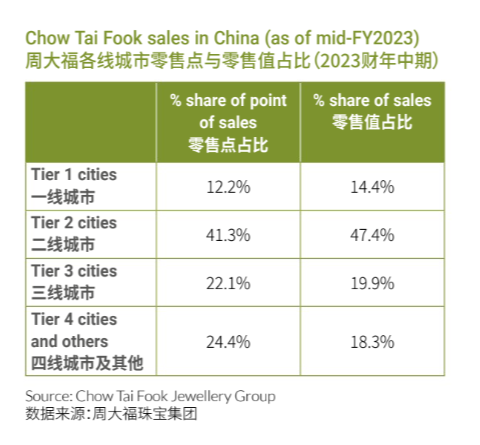

Chow Tai Fook accelerated the development of its retail outlets in Tier 3 and lower-tier cities in its financial year 2019 (from April 1, 2018 to March 31, 2019).

At a time when the government was progressively promoting the continued development of urbanisation and infrastructure in the lower-tier cities and rural areas, the conglomerate saw great potential for development in these locations, using the franchise model to increase market penetration in lower-tier cities, especially county-level towns.

Chow Tai Fook further expanded its market share in lower-tier cities in recent years with the strong support of its franchisees. In the past three years, the group increased the number of Chow Tai Fook retail outlets in mainland China from approximately 3,500 to over 7,000 and gradually increased its nationwide market share of seven to eight per cent to 10 to 11 per cent.

Kent Wong, managing director of Chow Tai Fook Jewellery Group, said, “Over the past few years, Chow Tai Fook capitalised on the opportunities in lower-tier cities and the strong demand from franchisees to open shops, enabling the brand to achieve the milestone of 7,000 Chow Tai Fook jewellery retail outlets by FY2023, two years ahead of schedule.”

To further expand brand influence and market share, the group launched the Boutique Project in early 2022, which shifts the focus to smaller-scale businesses that require less staff, moderate investments and reasonable returns. These stores can quickly penetrate the market while supporting the innovation and entrepreneurship of the younger generation. They also actively promote product differentiation and personalised offers, grasp consumption trends and bring the brand closer to customers.

According to Wong, the group’s initial target for FY2024 was to open 600 to 800 new stores in China but the actual number would depend largely on market opportunities. “Approximately 40 to 50 per cent will be directly operated stores, mainly in Tier 1 and Tier 2 cities. The remainder will be franchised shops, which will be the main vehicle for expansion into lower-tier cities,” he explained.

Market preference

Consumers in China’s different cities have their own set of preferences when it comes to jewellery, with plain gold pieces moving well in lower-tier markets.

According to the 2021 China Jewelry Industry Development Report released by the Gems & Jewelry Trade Association of China in April 2022, overall jewellery retail sales in China came up to RMB 720 billion (US$111.6 billion) in 2021.

Plain gold jewellery, jadeite and diamond jewellery were still the largest categories, accounting for 58 per cent, 14 per cent and 14 per cent of the market, respectively. Sales of plain gold jewellery alone reached RMB 420 billion (US$65.1 billion), growing 23.5 per cent year on year.

“Demand for gold jewellery is currently higher in lower-tier cities than Tier 1 and Tier 2 cities,” said Wong. “In addition, more young consumers in mainland China view diamond jewellery as a symbol of love. Since the wedding jewellery market in lower-tier cities has yet to be tapped, we are ready to capture this opportunity and enhance our product portfolio to meet the needs of millennials who are eager to express themselves.”

Growth opportunities

Wedding rings account for more than half of the Chinese diamond market, according to the 2022 Annual Diamond Trading Report by Shanghai Diamond Exchange. The number of marriage registrations in China has however been on a steady decline in recent years, data from the China Civil Affairs Bureau indicate.

Wedding rates peaked in 2013, which witnessed 13.47 million marriage registrations, before declining every year since. In 2022, only 3.732 million marriages were recorded nationwide, nearly half of the number registered in 2021. While 2022 was a unique case as pandemic-related disruptions prompted the postponement of most wedding plans, the downtrend in weddings could be difficult to reverse in a short period of time.

The report also pointed out that 80 per cent of newlywed couples in Tier 1 cities plan to purchase wedding rings, and diamond rings of 1 carat or more have become the preferred choice of many couples for their weddings.

Further growth in wedding jewellery sales is thus poised to come from second- and third-tier cities as well as lower-tiered markets.

Internet connectivity likewise plays a role in determining market potential. As of December 2022, the number of Internet users in China reached 1.067 billion, some 35.49 million more than was reported in December 2021, according to the 51st Statistical Report on the Development Status of the Internet in China prepared by the China Internet Network Information Center (CNNIC). The country’s Internet penetration rate meanwhile was 75.6 per cent.

Making inroads

All these growth factors echo the urgency for jewellers to expand in lower-tier cities.

Declining marriage rates imply that more young consumers intend to live independent lives, with more disposable income and greater opportunities for self-reward purchases. Establishing a strong presence in lower-tier cities will enable jewellers to better cater to these burgeoning customers. Omnichannel initiatives will likewise help promote brands to the billion of netizens in China.

Chow Tai Fook is bullish on the growth potential of lower-tier cities where consumers are likely to spend more on jewellery as per capita income continues to rise and consumer tastes gradually improve, Wong stated.

Unlocking the potential of these emerging markets however requires a tailored approach that identifies and caters to the values, motivations and preferences of local consumers. Companies need to offer products and services that meet the needs of their target clients in terms of quality, design, pricing and retail experience, among others. In addition, they should develop strategies to create awareness and build loyalty among luxury consumers in these areas.

Businesses must also communicate with customers through both digital and offline channels. Finally, they must devise promotional campaigns and pricing strategies that match the purchasing power of consumers in these cities while still maintaining their premium image.

Through such initiatives, jewellers can increase their market share in lower-tier cities and capitalise on the wave of luxury consumption in China.

China’s tier-city system

China’s cities are ranked on a matrix that includes GDP, income level, municipal administration and population. It also takes into consideration the concentration of commercial resources, importance as an urban hub, activity of urban residents, diversity of lifestyles and growth flexibility. Tier 1 cities are generally the most developed and have a high-income population and a higher cost of living. Tier 2 cities are less crowded, have a younger population and more technologically advanced sectors but costs are still relatively high. Tier 3 and 4 cities are on a growth trajectory, with a younger population with increasing disposable income, lower housing and living costs, shorter commutes and more leisure time. Infrastructure however is still being developed.

| Classification |

Cities |

|

Tier 1

4 cities

|

Beijing, Shanghai, Shenzhen, Guangzhou |

New Tier 1

(15 cities) |

Chengdu, Chongqing, Hangzhou, Xi'an, Wuhan, Suzhou, Zhengzhou, Nanjing, Tianjin, Changsha, Dongguan, Ningbo, Foshan, Hefei, Qingdao |

|

Tier 2

30 cities

|

Kunming, Shenyang, Jinan, Wuxi, Xiamen, Fuzhou, Wenzhou, Jinhua, Harbin, Dalian, among others |

|

Tier 3

70 cities

|

Taizhou, Haikou, Urumqi, Luoyang, Langfang, Shantou, Huzhou, Xianyang, Yancheng, Jining, among others |

|

Tier 4

90 cities

|

Yibin, Anshan, Nanchong, Qinhuangdao, Bozhou, Changde, Jinzhong, Xiaogan, Lishui, Pingdingshan, among others |