The pearl industry has proven its mettle in the face of health, economic and political crises, thanks to pearl traders’ ingenuity, inspired by the beloved gem’s enduring allure.

This article first appeared in the Pearl Report 2022-2023.

The world has changed drastically in the past two and a half years amid major health, political and economic headwinds. What remained steadfast though was the market’s insatiable appetite for luxury, including refined pearls and pearl jewellery.

International traders, designers and jewellery manufacturers are banking on the pearl’s timeless appeal to fuel market demand amid extraordinary times.

Digitalisation played a crucial role in staying in touch with clients and eventually, trading pearls through virtual channels. More educated and sophisticated consumers, especially from the Chinese market, are also fuelling a welcome shift in buying behaviours, which translates to greater appreciation and stronger demand for higher-quality pearls.

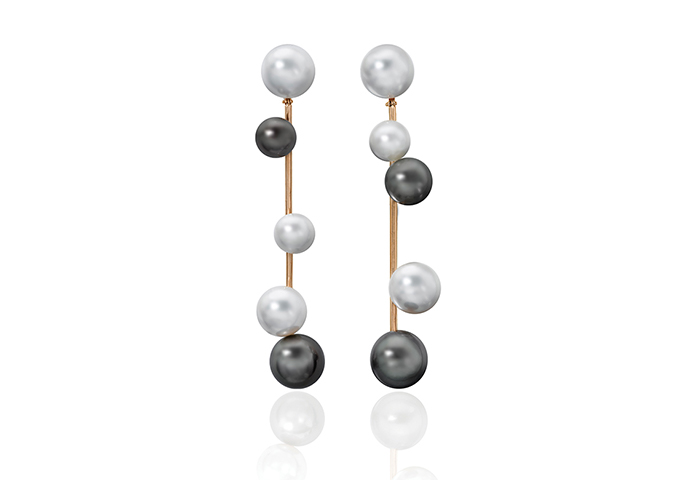

Pearl jewellery designs, meanwhile, are becoming more and more adventurous, edgy and innovative, placing the pearl’s versatile beauty to the test and earning the admiration of ever-discerning buyers.

State of the trade

Michael Bracher, executive director of Australia-based pearl specialist Paspaley, said supply of Australian South Sea pearls has remained relatively consistent amid Covid-induced fluctuations in consumer demand.

Australia has the longest production lead time, thanks to a longer husbandry period compared with other pearl producers so lower demand had little impact on short-term supply.

“As a result, the initial collapse in demand due to Covid did little to impact the short-term supply at the pearl farms,” noted Bracher. “The opposite is also true. Demand is now very strong, but it will be many years before this can have any impact on supply.”

By 2023 however, supply could tighten as effects of conservative seeding levels at the onset of the pandemic start to become evident, said Bracher.

Companies also had to find ways to meet rising demand and deliver goods to buyers in the face of stringent travel restrictions. Paspaley developed an online auction system and wholesale portal, which have greatly benefited customers since these provide them with additional information, including detailed images and videos of lots.

The virtual platforms also allow better cross-referencing of lots and prices from previous auctions. Paspaley’s clients can access its online stock portal to view single pearls, pairs and strands 365 days a year. Both initiatives provide a valuable service to customers and will be permanent fixtures in the company’s distribution system.

Bracher said consumers gravitate towards high-quality round and drop or oval-shaped pearls, regardless of size, with major markets China, the US and Europe exhibiting solid growth.

“The biggest change is the increased level of sophistication within the Chinese market. They have quickly become well-educated and discerning, which has resulted in better awareness and appreciation of pearl quality,” he revealed.

Just as pearl companies are effectively adapting to the new normal, work also carried on for gemmological laboratories. Laurent E. Cartier FGA, head of education at Swiss Gemmological Institute SSEF, said majority of SSEF’s research and work on cultured pearls and natural pearls over the past three years was centred on age dating and DNA fingerprinting of pearls.

“We tested several exceptional and historic natural pearls. These techniques brought new information and documentation on the pearls’ age and species to light,” shared Cartier. “We even discovered a new species of natural pearls submitted by a client. This species has never been reported in the jewellery industry – Pinctada persica.”

The natural pearl jewellery set consisted of 63 natural pearls – 61 strands and two loose pearls. SSEF said the pearls exhibited an attractive colour, subtly ranging from delicate cream to cream.

Radiocarbon dating confirmed they were “historic in age” while further analysis using DNA fingerprinting revealed that one of the pearls was from the Pinctada radiata species (Persian Gulf and Ceylon pearl oyster). Other pearl samples from the set were attributed to another species: Pinctada persica or Pinctada margaritifera persica. “To our knowledge, this is the first time that pearls from Pinctada persica have been reported. To date, this species has only been found exclusively in the Persian Gulf (Ranjbar et al. 2016),” noted SSEF in a case study.

Tahitian pearls

The Tahitian pearl industry also suffered an immense setback during the pandemic, specifically on the supply side. To combat these challenges, the Tahitian Pearl Association of Hong Kong (TPAHK) is intensifying growth strategies and implementing more dynamic marketing and promotional initiatives.

According to TPAHK co-president Johnny Cheng, the pandemic prevented Chinese grafters from travelling to French Polynesia to cultivate pearls. As a result, production sank by more than 30 per cent. This significant drop in supply, particularly of highly sought-after top-quality Tahitian pearls, also pushed prices up.

Amy Yan, co-president of TPAHK, revealed that round pearls remain the most popular while other sizes bearing decent colours and designs are also well-liked by customers. Buyers have also generally become more cautious when purchasing jewellery. What was selling however were trendy, daily-wear jewellery pieces with subdued designs.

Yan further commented, “The opening of borders in China and the rest of the world will pave the way for people to attend international trade shows once again. This in turn could lead to significant growth.”

TPAHK recently launched a DIY (do-it-yourself) workshop to teach participants how to make their own Tahitian pearl bracelets. This was well-received in the market, revealed Ida Wong, general manager of TPAHK. More workshops and seminars are in the offing to raise public awareness on Tahitian pearls. Joining the post-Covid digital revolution, several Tahitian pearl companies are also incorporating online solutions to their businesses such as virtual bidding systems for pearl auctions.

Pearl renaissance

Pearl jewellery designers are at the forefront of a pearl revolution, bolstered in part by the fashion industry’s relentless representation of pearls as the gem of the new generation.

According to Peggy Grosz, senior vice president at Assael, demand for pearls persisted despite Covid-related upheavals. She said retailers are eager to buy and replenish stocks, based on observations during two US shows that Assael attended in 2021 and 2022, respectively.

Buyers were partial to pearl strands of all types as well as uniquely designed pearl jewellery. Assael’s trendy and one-of-a-kind designs that combine pearls with coloured gemstones were highly favoured alongside its Bubble Collection by Sean Gilson for Assael, which featured South Sea and Tahitian pearls.

“Rare, exceptional gem-quality pieces are in demand, but I am delighted to say that the high-end consumer has also transitioned to innovative designs,” revealed Grosz. “They also support non-traditional combinations of materials like pearls with petrified wood.”

The challenge, she said, is continuously expanding these collections while maintaining perceived value. With increased emphasis on the pearl’s sustainability, enduring beauty and versatility, the price becomes less relevant, the company official said.

Assael is working on fresh initiatives to boost market demand, including bringing back and giving a new twist to classic Assael pearl and diamond jewellery pieces. “Pearls with ethically sourced diamonds are always a magical combination. And we are contemporising this illustrious pairing. An example would be our Bubble Diamond necklace by Sean Gilson for Assael. That is just the beginning of this journey,” shared Grosz. The company also started using lesser-known natural saltwater pearls in its latest collections, which garnered positive reviews from the market.

Sustainability

Cartier of SSEF said sustainability will play an even greater role in the future of the pearl sector, considering the worsening impact of climate change on many sectors. Pearl farmers, as frontliners, need to adapt and innovate. Consumers and brands meanwhile are increasingly sourcing responsible and sustainable materials. “Cultured pearls can meet many of these emerging consumer needs if they are farmed responsibly,” added Cartier.

Bracher, for his part, said Paspaley’s operations are already sustainable and have been certified by the Marine Stewardship Council (MSC), an independent London-based non-profit organisation that sets the highest standards for sustainable fishing. “Pearling already has a very low carbon footprint compared to other industries in the jewellery sector but further reductions are possible with focus and planning,” he noted.

With information becoming more accessible to buyers, there is also increasing visibility into the origins of products and their supply chains. “Consumers will become more discerning with their spending decisions. They will demand higher standards of social responsibility. In response to the increasing homogeneity of fashion and accessories, they are also likely to seek out products that express their individuality. This will bode very well for Australian South Sea pearls,” he added.