Sales of coloured gemstones over the last few years have increased substantially, driven by emerging markets and an increasing awareness by consumers of the beauty and variety offered by gems of colour. While the last two years of pandemic have brought significant changes to the sector, the industry is moving forward with remarkable resilience and ingenuity.

For its 2022 Colour of the Year, Pantone created a new shade – Very Peri, a blue hue with violet-red overtones. In explaining this move, the colour forecasting agency noted that Very Peri brings a novel perspective and vision of the trusted and beloved blue colour family as warranted in a world of unprecedented change. This applies as well to the coloured gemstone industry, which is exploring fresh offerings and notable business prospects in post-Covid markets.

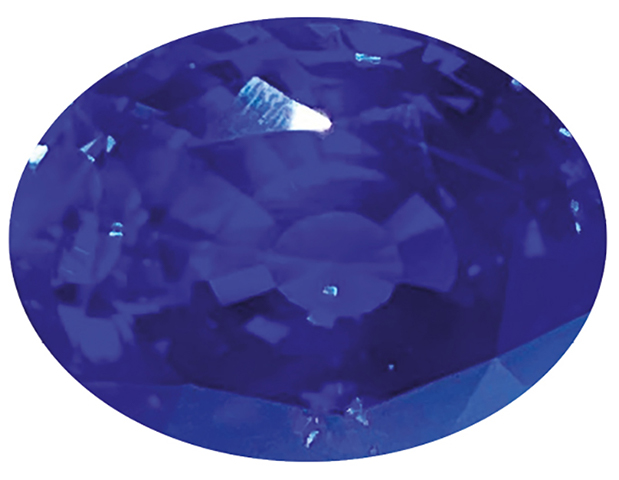

For starters, the Pantone pick reinforces demand for already popular blue stones while boosting awareness of lesser-known gems. A trendy addition to the fashion industry, Very Peri has been adopted too by jewellery designers, using gems such as purple sapphire, spinel and tanzanite, among others.

“It is nice to see bright and beautiful colour palettes displayed and used in the gemstone industry,” said Niveet Nagpal, owner and designer of US-based Omi Privé. “We are incredibly excited to use Very Peri and its complementary colours in our upcoming designs.”

Zoe Michelou, owner of Thailand-based Imperial Colors, has seen growing demand for purplish stones because of Pantone’s selection for 2022. “More enquiries are coming in for the ‘Very Peri’ colours, especially tanzanite and sapphire, plus other purplish gems, which are now popular in our main markets, namely the US and Europe,” she revealed.

Favoured gems of colour

The consensus is that the Big Three – emeralds, sapphires and rubies – will continue to be bestsellers in 2022. But many other beautiful gems are not far behind.

Rising in prominence among this vast selection is Paraiba tourmaline. “Although we sell a lot of the Big Three, our most popular stone is Paraiba,” said Caroline Chartouni, owner of US brand Caroline C. “We get enquiries every week for this neon-blue gem.”

Chartouni adds that aquamarine is becoming more sought after, as well as pink tourmaline, for her primary markets of the US and the Middle East.

For Elke Berr of Switzerland-based Berr & Partners, sapphire is the top gem, followed by emerald and ruby. “Fine Burmese rubies are expensive and difficult to sell now because of Myanmar’s political situation. The big brands do not want them, so this leads to increased demand for Mozambique rubies,” she shared.

Berr also feels that Paraiba tourmaline is highly favoured along with other blue stones, including cobalt spinel, tanzanite and indicolite, as well as amethyst, which are appreciated in her main markets, namely the US and Europe.

“All the precious gems will be popular this year,” said Lewis Allen, CEO of Thailand-based Crown Color, which sells internationally. “We see a strong demand for pink sapphire.” He also notes a re-emergence of Mahenge spinels, with new production in Tanzania producing many new and large sizes.

Colombian emeralds continue to be favourites. “From the second half of 2021, we have seen a 30 per cent increase in demand,” disclosed Guillermo Galvis, president of the Colombian Emerald Exporters Association. The biggest markets for emeralds are the US, China, the Middle East and India.

New sources of sapphire and ruby have been found in Cauca, southwestern Colombia, and will hit markets later, he added.

Gemolithos CEO Ioannis Alexandris, who closely follows the world’s major auctions, remarked, “It is no surprise that the Big Three dominate sales, along with coloured diamonds, and that prices have risen dramatically.” He likewise observes greater demand for soft colours, such as in kunzite and light amethyst, as well as pale yellow and pink sapphires.

“Teal and peacock sapphires as well as polychrome parti sapphires are attracting more consumers,” offered New York-based Joe Menzie, president of gemstone company Joseph Menzie Inc, whose main market is the US. “Red and pink spinels, as lesser-priced substitutions for ruby, are also enjoying increased demand. The many colours of garnet and tourmaline will likewise see renewed interest.”

Duncan McLauchlan, owner of UK-based McLauchlan Gems, agrees that hot designer gems are teal sapphires, Paraiba tourmaline and spinel, noting though that supply in any reasonable size and quality is limited.

Gemstone dealer Evan Caplan believes that spinel – especially red, pink and blue ones – will become even more popular along with other gemstones that are in short supply such as Brazilian alexandrite, Padparadscha sapphire and Brazilian Paraiba tourmaline. Caplan has also achieved great success with fine cat’s eye chrysoberyls, star sapphires, trapiche emeralds and Russian demantoid garnets.

The last few years have indeed seen a substantial rise in pastel Padparadscha sapphire, Paraiba tourmaline and, more recently, grey spinel and teal sapphire, according to Helen Molesworth, marketing director for Singapore-based gem platform Gembridge.

She predicts these colour ranges – including polychrome gems with green-blue and purple-grey tones – will become more popular as people gain confidence and trust their own personal colour choices. “We also expect rising interest in the garnet and tourmaline families, with their wonderful rainbow of choices,” Molesworth added.

Promising signs

The Covid-19 pandemic has caused serious disruptions in global supply chains, which are still being felt to this day. Restrictions continue to hamper travel between some countries, with negative consequences particularly for Africa. Although artisanal and small-scale miners were able to work, there were few international buyers. Even when large-scale mines reopened after the lockdown, they faced difficulties due to travel restraints and logistical problems.

Today, fewer travel restrictions and some re-linking of supply chains indicate signs of recovery. “My outlook is positive,” stated Gamini Zoysa, managing director of Sri Lanka-based Ceylon Gemological Services. “I was recently in the gem trading town of Beruwala and it was packed with traders and buyers, many preparing for the Tucson gem shows.”

McLauchlan is optimistic, too. “I think 2022 will be an exciting time for the industry. Production is starting up again, restrictions are being lifted and everyone is keen to get rolling. We expect to see some important business done in the next few months,” he explained.

Supply of fine-quality stones is still an issue as prices are very high, but demand for the best is outstripping supply tenfold, if not more, in his main markets of the UK and the US, he added.

Philip Zahm, CEO of Philip Zahm Designs in the US, recalled, “When Covid started, everybody was terrified and expected the worst, but things quickly turned around and many jewellers had their best couple of years ever. During this past December and January, they were overwhelmed with demand for coloured stone jewellery and loose gemstones. I feel quite positive about the coloured stone market in 2022.” Michael Koh, owner and creative force behind Singapore-based fine jewellery brand Caratell, believes coloured gems will still be strong this year, noting that millennials are increasingly turning their attention towards coloured gemstones for engagement rings.

While Jeffery Bergman of Thailand-based Primagems also sees a strengthening of the coloured stone market this year, he warned that the Covid-19 pandemic will have an ongoing impact on the trade, although hopefully to a lesser extent this year.

“Supply issues will continue to be problematic. For example, rough traders from Africa have supplied cutting factories in Chanthaburi and Bangkok for decades, but travel restrictions eliminated 80 per cent to 90 per cent of this supply chain over the past two years. Consequently, cutting factories have reduced staff, with some closing,” Bergman explained. “If pre-Covid supply and demand were to return to Thailand’s gem market, an inevitable labour shortage will drive up prices and challenge delivery reliability.”

This caution was reiterated by Michelou. “Because of Omicron, we are seeing long deliveries due to labour shortages at our cutting factories and even with our couriers. During Covid, some workers changed jobs so, while demand is up, we lack employees, and those who remain expect higher salaries.” She noted the couriers have also raised their rates, contributing to overall price increases. Despite these challenges, Michelou remains upbeat on business prospects this year.

And while optimistic for 2022, Germany-based Constantin Wild commented, “This will be a challenging year due to the travel restrictions and trade show uncertainties, yet we expect business to be good because of a strong demand for luxury items.” The lapidarist cites morganite with strong pink tones as one of the emerging gems this year.

New shapes, new uses

Colour is an important aspect of any gem purchase, but custom carvings are on the rise. In their new collection, Synergy & Symbiosis, jewellery artist Paula Crevoshay teamed up with noted gem carver Glenn Lehrer to produce a series of carved gems set in jewellery. “There is a growing movement towards modern art jewellery, exemplified by unusual cuts and colours,” said Martin Bell, vice president of US-based Crevoshay.

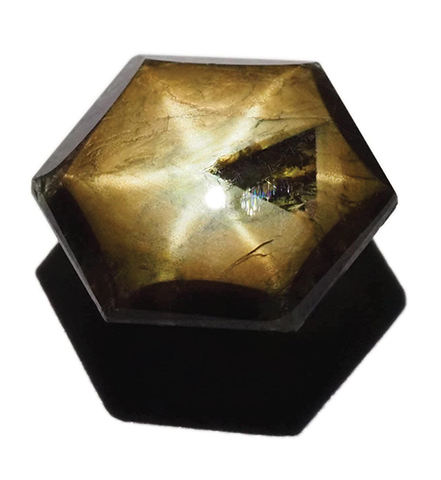

Another company using interesting cuts is Thailand-based Genuine Gems & Jewellery. “When a new species of sapphire was discovered in Kenya a few years ago, we looked for different ways to bring out its natural beauty,” shared company owner Tanzim Khan, adding that these Gold Sheen™ sapphires continue to increase in popularity in the international market. “Aside from their uniqueness, they are mined in a socially responsible manner,” he continued.

While good-quality gems are destined for jewellery or collectors, new uses are emerging for the rest. Thailand-based field gemmologist Vincent Pardieu has documented “gem painters” in Southeast Asia who use low-quality coloured gems to make beautiful works of art.

“The benefits of gem painting go beyond the artists,” he said. “Miners are able to get a regular income from the low-quality stones, thus allowing them to continue searching for quality gems. Jobs are created all around, thus helping to eliminate poverty.”

Question of ethics

While a gem’s quality, colour and shape are certainly important, today’s consumers increasingly want to know if the gem was responsibly sourced. “Ethical supply chain” is more than a buzz phrase. It is an integral part of a gem’s story, telling of its journey from mine to market.

Among companies that take ethical supply chains to heart is US-based Virtu Gems, which sources gems from Malawi, Kenya and Zambia. “Our goal is to make mining sustainable and improve conditions in mining communities,” explained co-founder Susan Wheeler.

Since her biggest markets are jewellery designers in the US and Europe, Wheeler expects the most sought-after gems to be trapiche emeralds, unique coloured sapphires, rutilated gems, cat’s eyes, star sapphires and star rubies. Artistic faceting is also a continuing trend in gems such as black tourmaline. A market exists as well for “healing stones with ethical provenance,” she added.

France-based gemstone dealer Piat collaborates with Moyo Gems, an organisation working with female artisanal miners in Kenya and Tanzania to ensure better working conditions and fair prices. Company CEO Emmanuel Piat said, “Ethical sourcing, transparency and sustainability are what our main markets in the US, Europe and Asia are asking for.”

In terms of favoured gems this year, Piat said, “Mozambique pink rubies and the fluorescent Mahenge spinels will be very popular, while teal and autumn colour sapphires will continue their rise, along with Umba sapphires from Tanzania.”

In its March 2021 report on coloured gemstones, Future Market Insights tracked sales in over 20 countries. Based on its research, coloured gem sales are expected to grow at a healthy compound annual growth rate of over 5.7 per cent from 2021-2031, exhibiting a positive recovery from the period of muted growth in 2020. Current market indicators affirm this possibility as the industry moves forward.