Resurgent consumer demand coupled with the rising number of middle-class buyers with higher disposable incomes and relentless modernisation efforts are bolstering growth in China’s jewellery trade.

Several trade developments are supporting China’s return and recovery efforts amid the continued onslaught of Covid-19. These range from strengthening economic fundamentals and consumer sentiment to market expansion initiatives, to name a few.

Annual retail sales of gold, silver and jewellery products by major jewellers in China were up 29.8 per cent year on year in 2021 to RMB304.1 billion (around US$47.14 billion), placing this category ahead of other consumer retail market segments, revealed data from the National Bureau of Statistics of China.

For jewellers to qualify in the key sampling segment of the study, they must have annual sales of RMB5 million (around US$775,000). This is further indication that China’s retail business is dominated by medium to big-sized jewellers.

Glittering imports

From the end of the third quarter of 2020 throughout the fourth quarter, diamond trading volume via the Shanghai Diamond Exchange (SDE) witnessed a strong rebound. Imports recovered at an accelerated pace, with monthly net polished diamond imports exceeding US$200 million in September, October and November, and US$191 million in December 2020.

The volume of net polished diamond imports through the SDE reached 2.8 million carats in 2021, demonstrating a year-on-year uptick of 95.5 per cent. The figure is up 63.7 per cent from pre-Covid 2019. This reflects the high growth potential and resilience of the Chinese diamond market.

By value, net polished imports hit a record high of around US$3 billion, surging 105.3 per cent compared to 2020 and 58 per cent from 2019. The SDE is the only portal in China to import polished diamonds under a zero per cent tariff policy and 4 per cent Value Added Tax, therefore the figure reflects the value of polished diamonds imported for consumption in China.

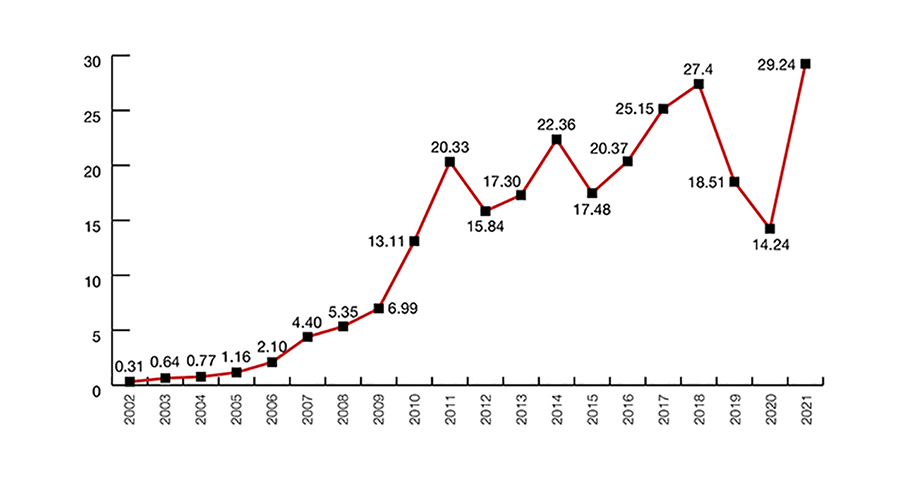

From 2002 to 2021, net polished imports passing through the SDE have grown from US$31 million to about US$3 billion, showing a 94-fold increase and an average compound annual growth rate of 27 per cent.

“The historic growth in diamond imports in 2021 proves that the economic fundamentals and underlying factors supporting the long-term development of China’s diamond market remain unchanged and indicates that China’s diamond imports shall sustain waves of growth for a long time to come,” remarked Lin Qiang, vice chairman of the World Federation of Diamond Bourses and president of the SDE.

During the Global Gems and Jewelry Development Conference held in January 2022 in Hainan Province, the Gems and Jewelry Trade Association of China (GAC) revealed that China’s diamond jewellery segment reached roughly US$12.4 billion in 2021, accounting for 13 per cent of the country’s jewellery market. By comparison, the average share of diamond jewellery in the global market is 26 per cent. Although China is the second largest diamond jewellery consumer in the world, the local diamond jewellery sector, which is significantly lower than global average, is poised for further growth.

Golden opportunities

Securities trading and brokerage firm China Merchants Securities Co Ltd said in a report that gold jewellery sales continued to be strong during the Chinese New Year. Research showed that in January, ahead of the CNY celebrations, sales of major jewellery brands in select areas rose by 47.29 per cent year on year.

Comparing the CNY sales period of 2021 (February 4 to 14, which included Valentine’s Day) and 2022 (January 25 to February 4), this year’s sales were up 12.8 per cent compared to last year despite a high baseline.

Domestic brands such as Lao Feng Xiang and Chow Tai Sang, for instance, saw sales increases of more than 50 per cent to 60 per cent in majority of their shops. Hong Kong-based jeweller Chow Tai Fook meanwhile recorded double-digit growth in retail sales in mainland China from January 1 to February 6, 2022.

China Merchants Securities also revealed that consumer enthusiasm for gold is expected to continue for another three to five years. This in turn will fuel demand for gold jewellery.

Plain gold jewellery accounts for around 55.7 per cent of the jewellery retail market. Recent developments showed that local retailers have been increasing the range of per-gram priced items in their inventory. Consumers have been clamouring for an adoption of a per-gram pricing method, which is deemed more transparent, or for retailers to disclose the weight of the product in grams if they are priced by the whole piece. There are concerns however that this practice may affect the quality of design and craftsmanship.

The research also showed that the average monthly sales required for a single store to break even has leapt from RMB200,000 to RMB300,000 (around US$31,000 to US$46,500) to RMB600,000 to RMB700,000 (US$93,000 to US$108,500). This is expected to lead to further business consolidation in favour of larger-scale companies. Jewellers meanwhile are likely to gravitate more towards diamond jewellery or coloured gemstone jewellery, which accounts for around 5 per cent of the market, for better profits.

Manufacturing hub

Panyu, a district of Guangzhou City in Guangdong Province, hosts more than 400 jewellery manufacturing enterprises from over 30 countries and regions, and around 1,000 coloured gemstone cutting factories and more than 2,000 sales companies.

Over 70 tonnes of coloured gemstones are set into jewellery every year in Panyu. The district is targeting an annual production of more than RMB100 billion (around US$15.6 billion) as it transitions from a “Made in Panyu” to the “Created in Panyu” distinction.

As a highly influential association that represents jewellery manufacturers in the district, the Guangzhou Panyu Jewellery Manufacturers Association last year hosted a series of exhibitions, competitions and events involving vocational skills, design, product promotion and trends broadcasting.

“In 2022, our association will continue to act as an ‘advisor’ for government supervision, a ‘service provider’ for enterprise development and a ‘supervisor’ for business practices,” said Wu Wei, president of the Guangzhou Panyu Jewellery Manufacturers Association.

The group is aiming to launch more omnichannel initiatives to promote its members and enhance their presence in the trade. Furthermore, the association will also assist them in carrying out their digital

transformation initiatives.

Among China’s major manufacturers is Shenzhen-based Xingguangda Jewelry. It operates a massive manufacturing complex in Dongguan, a city adjacent to both Shenzhen and Guangzhou. Covering 10.9 acres of land, the facility has a workforce of 1,200 employees and manufactures over one million pieces of jewellery for over 4,500 retailers in China every year.

Constantly pursuing innovation in manufacturing including new materials, business models, designs and technology, Xingguangda is focusing on production quantity and smart manufacturing to cater to rising demand for personalised designs from clients, particularly millennials and Gen Z.

There is also a growing trend for a highly efficient, responsive and flexible smart production line in the jewellery manufacturing business. Automatic wax injection machine, 3D printing, CNC precision carving machine, and other high-tech equipment and technology play an important role in today’s highly competitive sector.

Big data management system meanwhile can accurately capture and interpret consumer demand. A more systematic, accurate and digitalised management system also raises the need for patents to protect intellectual property rights.

Xingguangda also operates its own jewellery business academy, which combines online vocational and professional courses and offline training.

Moving forward

According to the National Bureau of Statistics of China, the country’s gross domestic product (GDP) grew 8.1 per cent year on year in 2021 compared to the two-year average growth rate of 5.1 per cent. The high-end consumer market for diamonds and jewellery usually tends to expand alongside a country’s sustained economic advancement.

With a national policy in place to stimulate domestic consumption, China’s economic growth is transitioning from an export and investment-oriented model to a consumption-driven one. In 2021, consumption spending accounted for 65.4 per cent of the economic development, driving the GDP growth by 5.3 percentage points. This indicates that consumption has become the main force behind China’s steady recovery. The National 14th Five-Year Plan, beginning 2021, is meant to unlock higher spending power in the country's lower-tier cities and suburban areas.

Online penetration of jewellery meanwhile increased from 7 per cent to 10 per cent in 2021, according to a Bain & Co report on China’s personal luxury market. As major jewellers further expand their footprint to third- and fourth-tier cities, more consumers can easily access information and products.

As of January 2022, China has fully vaccinated at least 86 per cent of its entire population. The Covid-19 pandemic has been effectively contained in 2020 although there are still some sporadic outbreaks. Retail has bounced back and most jewellers anticipate local consumption recovery to continue through 2022 given the lack of international travel.