Auction houses are increasingly engaging buyers in mainland China for their jewellery sales, as the market warms to the concept of pre-owned jewellery and makes its presence felt at auctions in Hong Kong and the mainland.

From international auction houses established in the 18th century with operations in Hong Kong and mainland China to local Chinese counterparts with a geographic and hometown advantage, jewellery auctions are gaining a foothold in the China market, with jewellery lovers, consumers and professional buyers frequenting sales in Hong Kong and the mainland.

Hong Kong is a mature and well-established centre for auctions. Over the decades, international auction houses have built solid foundations, reputations and clienteles in the city, which often serves as the base of their Asian operations.

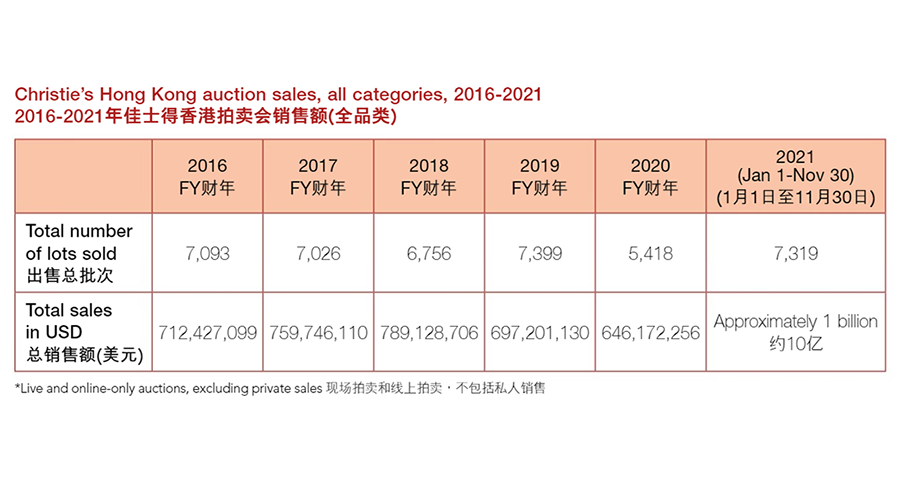

Christie’s auctions in Hong Kong span more than 80 art and luxury categories, at price points ranging from US$200 to over US$100 million.

In the last five years, sales results indicate both an increase in the prices of items offered and collectors’ preference for top-quality masterpieces. Running sales from January to end-November 2021 exceeded total sales for the auction house’s 2020 financial year.

Christie’s first established its office and flagship international sales hub in Hong Kong in 1986 to facilitate business in Asia. In 2013, it became the first international auction house to be granted a license to operate independently in mainland China. In September 2013, Christie’s hosted its first live auction on the mainland and held annual sales in Shanghai till 2019, before the Covid-19 pandemic disrupted schedules in 2020. Apart from its Shanghai company, Christie’s also has gallery space and a representative office in Beijing.

Mainland demand

In recent years, international auction houses have witnessed growing demand for top-quality jewellery pieces in their Asian sales. Buyers from mainland China, consisting of individual private collectors and trade buyers, are increasingly active in Hong Kong auctions.

Vickie Sek, chairman of the Department of Jewellery at Christie’s Asia Pacific, said, “Mainland Chinese buyers are very fast learners and extremely knowledgeable, favouring crème de la crème pieces. They collect almost every kind of popular gemstone you can name and are particularly fond of coloured diamonds, emeralds, sapphires and rubies. Clients from mainland China are partial to jadeite because of the gem’s long historical and cultural relevance. They are also keen to purchase pieces with simple yet elegant designs.”

Yongle Auction, established in 2005, traditionally holds two auctions a year in Beijing – its Spring Auction in May and its Autumn Auction in December. Prior to the sales, it holds previews in Beijing, Shanghai and Shenzhen. The mainland-based auction house noted that buyer preferences vary across the different regions of the country.

According to Tian Keqing, a specialist at Yongle Auction’s fine jewellery and luxury department, buyers in the Beijing region are more interested in coloured gemstones and diamonds. Of late, demand for Western antique jewellery and watches has been on the rise. Meanwhile, buyers in Shanghai gravitate towards branded jewellery, designer jewellery and Western antique jewellery.

"The level of jewellery awareness, knowledge and preference varies between mainland cities and between mainland China and Hong Kong. The experience and maturity of the market in these different geographic areas play a substantial role in determining the preferences of consumers. Auction strategies and lists are adjusted based on the profile of the buyers,” explained Tian.

Cultural differences however do not hinder mainland activity at auctions. Christie’s Sek noted that buyers from mainland China are receptive to the concept of auctions and are avid participants in Hong Kong sales.

“They buy at auctions because of the quality, design and selection of gemstones. Provenance is another draw – pieces once owned by royalty, imperial courts and esteemed families are attractive to this market,” the company official revealed.

Aside from buying at Hong Kong auctions, some mainland Chinese collectors also look to sell items at the sales. Travel limitations due to Covid-19 restrictions however currently prevent them from bringing their jewellery pieces to Hong Kong.

Tian of Yongle Auction agrees that auctions are making headway in the mainland China market, as evidenced by growing participation in local sales.

“At first, I was worried that Chinese consumers would be bound by traditional thinking and have concerns about buying pre-owned jewellery. But, in fact, most of our customers, especially younger people, embrace the concept of auctions. Many of them have good knowledge of European art history and are fascinated by the exquisite craftsmanship and unique designs of antique jewellery. They use jewellery to showcase their own personality and taste,” said Tian.

Customer outreach

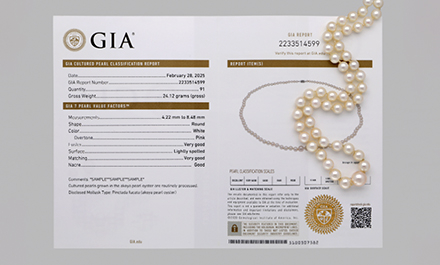

Christie’s engages clients from mainland China through previews, art talks and academic courses by Christie’s Education to help them expand their knowledge and cultivate their interest in jewellery and in buying at auctions. It provides condition reports for every lot at its auctions upon request. Detailed catalogues list the certifications for particular lots.

Buyers from mainland China and the rest of the world can also take part in the jewellery live auction by placing absentee bids, phone bidding and using Christie’s Live – a wholly owned platform that allows real-time bidding at live auctions on Christie’s website and mobile app.

While the pandemic adversely impacted business across all industries in 2020, the auction market adapted and quickly rebounded.

The main auction houses started online auctions in China, geared mainly towards junior collectors. Aside from investment purposes, bidders are motivated by collecting valuable, interesting items and improving their quality of life, said Tian.

Due to limitations in the display of lots, categories at online auctions tend to be confined to mostly jadeite and other jade jewellery, postage items, woodblock printings and small works of art. High-specification lots are usually reserved for traditional auctions, she remarked.

Christie’s is bullish about business prospects in mainland China, pulling out all the stops to reinforce its brand and engage the market despite upheavals brought about by the Covid-19 pandemic.

In May 2020, it announced its partnership with China Guardian Auctions. The two enterprises planned to host an auction together that September, but this was postponed due to pandemic-related restrictions.

Christie’s rapidly pivoted to online channels and invested heavily in digital initiatives to connect with buyers who could not physically visit auctions and previews due to the pandemic.

It ramped up the capabilities of its WeChat mini-program, which now enables phone bidding and absentee bidding in live auctions. Technological innovations include enhancing product presentations with virtual tours, virtual viewing rooms, e-catalogues and SuperZoom focus, among others. The auction house further expanded its social media footprint by launching its official account on user-generated product review platform Xiaohongshu or Little Red Book in the spring of 2021.

Christie’s also made its debut at the China International Import Expo (CIIE) in November 2021, offering collectors in China an opportunity to appreciate and acquire top-quality works from its carefully curated selection of masterpieces. The expo not only enabled Christie’s to raise its brand awareness and promote mutual understanding between the brand and the general public, it also encouraged the firm to formulate new strategies to expand and deepen its footprint in China.

Christie’s is optimistic about its business on the mainland, said Sek, citing high bidding interest across categories including jewellery.

“Under the leadership of Rebecca Yang, our newly appointed chairman in China, and the collaborative efforts from our Hong Kong office, the response to our recent programmes on the mainland has been extremely positive, from CIIE and the Radiance Show that attracted 1,800 visitors over three days to our successful previews in Shanghai and Beijing. Bolstered by our industry-leading digital capabilities, particularly our WeChat bidding functions, we are looking forward to an even deeper footprint in China in the future,”

remarked Sek.

Jewellery is an emerging category at auctions in China, one that continually exhibits encouraging positive growth, according to the Review of 12 Artifacts and Arts Auction Companies Nationwide 2020 report by the China Auction Association.

Paintings, calligraphies and porcelain account for around 80 per cent of auction sales of Artifacts and Arts on the mainland. But the jewellery, including jade, category has been steadily growing its market share of artifacts and arts sold at auction, from 2.35 per cent in 2019 to 3.81 per cent in 2020, the report noted.

While still relatively small, China’s jewellery auction market has the potential to become a major force in the international scene. The number of jewellery collectors and traders on the mainland has grown substantially in the last 20 years. Chinese collectors are now offered more diverse jewellery lots, and the secondary market for jewellery is expected to continue on its upward trajectory.