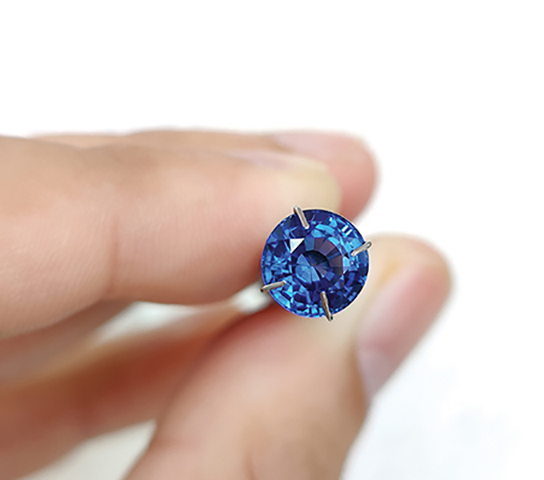

Sapphires are among the most desired gems in the world, with the finest stones often categorised as “peacock blue,” a shade of royal blue with a velvety appearance similar to the colour of a peacock’s neck.

Historically, Kashmir has produced highly prized gems due to their rarity, followed by Myanmar, Sri Lanka, Madagascar, Australia and Montana, US, according to Suhail Salahudeen, a gemstone consultant at Thailand-based Star Lanka Co Ltd.

Of these destinations, Madagascar has risen to become a major sapphire source with production in Sri Lanka, owing to the depletion of Kashmir mines and limited mining in Myanmar, shared Anthony Brooke, chairman of gemstone trading platform Gembridge. According to Brooke, sapphires from Madagascar are increasingly commanding attention in the trade.

The business of sapphires

Armil Sammoon, chairman of Sapphire Capital Group and Sri Lanka’s ambassador to the International Colored Gemstone Association, explained that many sapphires found in Sri Lanka exhibit the same velvety characteristics as Kashmir sapphires. Fine stones can also be found in Nigeria, Cameroon, Ethiopia, Rwanda and Thailand.

Investment-grade stones primarily from Kashmir however are from old inventory and are seldom found at auction, noted Brooke.

The market’s appetite for top-quality sapphires remained strong throughout the pandemic. Fung Chiang, vice president and senior jewellery specialist at Christie’s Asia Pacific, said this was evidenced by the recent sale of a 14.70-carat Kashmir sapphire ring for HK$10.32 million (around US$1.32 million) at Christie’s Hong Kong.

Demand for sapphires has risen steadily over the last decade amid tighter supply and high prices, noted Salahudeen. Demand for medium-quality sapphires is highest in China while the US favours heated stones. The finest-quality sapphires are usually sold in Europe.

Supply continues to be a pervasive issue. Sapphires now primarily come from Sri Lanka, with many large stones of 10 to 20 carats being unearthed there. “As far as commercial qualities, the market is still looking at Nigerian material,” noted Brooke. “Sapphires from Madagascar in commercial or medium to better grades are being mined but held up during Covid. The large commercial volumes are not making their way to Sri Lanka, where they are processed.”

There is also very little production from Myanmar. Andrey Kornilov, managing director of Gem Matrix, said many countries are imposing embargo laws on the trade of Myanmar stones, which discourages buyers.

A new supply of Australian sapphires within the year by gemstone specialist Fura Gems however is expected to bolster market inventories “Fura plans to produce over six million carats of sapphires in 2021 and over eight million carats next year. Blues will be a fair bit of the overall production,” said Fura Gems Chief Marketing Officer Rupak Sen.

Fura Gems and diamond brokerage and consultancy firm Bonas Group are hosting their first tender of Australian sapphires in Bangkok in November. This will include large quantities of top- to medium-quality stones, featuring a variety of colours such as blue, blue-green, green, yellow and parti-colour. Fura Gems expects approximately 30 to 35 companies from Thailand, Sri Lanka, India and the Middle East to participate.

Buyer preferences

Brooke said Europe continues to buy sapphires from major producers such as Kashmir, Myanmar and Sri Lanka while the US opts for mostly large volumes of commercial and calibrated stones.

Chiang of Christie’s Asia Pacific witnessed a surge in buyers from China while Sammoon cited India’s rising interest in blue sapphires of 5 carats to 25 carats for domestic use.

Colour is the most important factor in Asia, revealed Kornilov of Gem Matrix, adding that Asian countries are deeply focused on royal blue and cornflower blue sapphires from Sri Lanka.

Chinese buyers are keen on blue sapphires but prefer unheated stones and are diversifying from Sri Lankan to Madagascar sapphires, noted Brooke. “China does not want heated sapphires. It is difficult to meet demand consistently unless they start buying fractured stones with fissures,” he added.

Other Asian countries meanwhile go for Burmese and Sri Lankan stones while Madagascar gems are gradually being accepted in the market.

“Known origin matters a lot when marketing and can set a higher price due to the cost of procuring ethically sourced blue sapphires,” explained Navneet Agarwal of Thailand-based Navneet Gems and Minerals. Agarwal sees the US as the biggest market at the moment.

Salahudeen however said gemstones should be priced based on their beauty and not origin, adding, “Indeed, Kashmir sapphires are rare, but those from Madagascar are some of the most beautiful I have seen.”

Covid-19

A recent surge in Covid-19 cases in Sri Lanka has resulted in mining disruptions that, in turn, impacted the market, said Agarwal. Salahudeen remarked that Covid-19 affected the industry for a few months only and business has resumed, including e-commerce. He noted an uptick in demand as many dealers are looking to replenish stocks.

Industry events have also helped sustain momentum albeit through online platforms.

Sammoon explained that the new government in Sri Lanka is working with gemstone associations to provide new rough material to the market.

Obtaining the stones directly from their source has become exceedingly challenging, said Kornilov.

With the limited supply of rough materials and travel restrictions, “business is mostly conducted with African dealers walking into our offices and selling the rough,” Agarwal explained.

He added, “Pre-Covid sales were down because people were saving money. Now people are spending their disposable income, boosting sales by at least 30 per cent to 40 per cent.”

Kornilov, for his part, observed a 20 per cent to 30 per cent decrease in sales for commercial-grade sapphires compared to pre-Covid levels. “The market certainly became difficult as majority of gemstone manufacturers relied on international shows for potential buyers. Buyers have become more selective when it comes to sapphire choice and quality,” he added.

The medium- to low-quality sapphire market was the worst hit due to slower distribution.

Dazzling prospects

Bright opportunities await the sapphire industry, said Kornilov, citing new deposits from Madagascar, Sri Lanka, and large quantities of rough from Nigeria and Ethiopia. “The deposits may be larger than expected and contain a great variety of stones, which we are all looking forward to seeing on the market,” he added.

As the pandemic eases, traders expect to see an overall uptick in jewellery sales. Sen of Fura Gems commented, “We are seeing more millennials buying coloured gemstone jewellery. People are celebrating key moments in their lives with an elegant piece of jewellery. We expect this trend to continue into the full decade.”

Fura Gems also vowed to assist the trade through its Fura Marketing Council programme. “We are confident to position Australian blue sapphires on a global aspirational list. The consistent supply will add confidence and help traders take a long-term view on the category, leading to more manufacturing and retailers stocking and selling Australian sapphire,” Sen said.

Consumers are developing a taste for unique alternatives to the classic blue sapphire, with teal and parti-sapphires, mainly sourced from Montana and Australia, emerging as new favourites. Traders see a bright future ahead as such emerging categories could have a strong positive impact on the market. These two distinct colours are far more easily obtained through heat treatment than blue sapphires. Heat treatment can take several weeks to achieve the desired blue colour whereas parti-sapphires require a week of heat treatment to achieve the variegated colours. “This can be very advantageous since we can use the same rough material to create blue and teal sapphires,” noted Sen.