The Covid-19 pandemic initially wreaked havoc on China’s jewellery sector. But as the dust settles, jewellers are capitalising on market consolidation, e-commerce opportunities and changing consumer habits for long-term growth.

China’s jewellery market is well on its way to recovery from pandemic-induced woes as key indicators point to an uptick in consumption.

According to data from China’s National Bureau of Statistics, jewellery retail sales of companies with annual revenues over RMB 5 million (US$770,000) increased by 98.7 per cent year on year to RMB 54.5 billion (US$8.4 billion) in January and February 2021. The average growth rate for the same period in the last two years is 8.2 per cent.

With the government encouraging people to stay put for the Chinese New Year holidays in February, funds earmarked for travel were diverted to consumer goods including jewellery.

A study by the Ministry of Commerce showed a 160.8 per cent year-on-year increase in jewellery retail sales during Chinese New Year 2021 for a sampling of key jewellers.

“As Covid-19 remains a global threat, Chinese nationals have cut down on shopping overseas. Part of consumer demand has shifted to domestic consumption, driving the growth in sales of cosmetics, jewellery, watches and bags, among others,” explained Zhang Min from the Trade and Foreign Economy Department of China’s National Bureau of Statistics.

“Pandemic restrictions led to greater acceptance of online shopping along with rapid development and strong momentum for new forms of businesses," he continued.

The initial onslaught of the Covid-19 pandemic hit jewellers hard in 2020 but double-digit gains from September to December contained losses in jewellery retail sales last year to a mild 4.7 per cent contraction to RMB 237.6 billion (US$36.6 billion), according to data from the National Bureau of Statistics.

Restrictions on foreign travel buoyed business for international luxury jewellery brands. Tiffany & Co grew its sales in mainland China by over 70 per cent in the third quarter of 2020. Sales during its 2020 holiday season from November 1 to December 31 more than doubled year on year.

Retail landscape

Unlike in the US where independent retailers abound, chain stores dominate China’s jewellery retail scene.

The 10 top chain stores in China have a combined total of around 20,000 points of sale nationwide. According to Euromonitor, these chains accounted for 23 per cent of China’s jewellery retail sales in 2019.

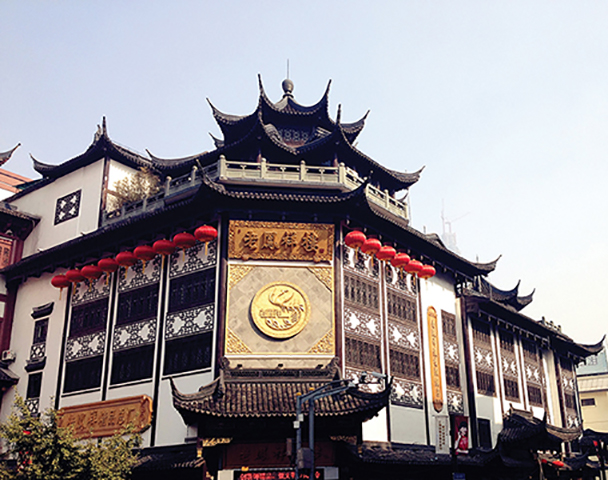

Three types of jewellery brands operate in the market: Mainland Chinese brands such as Lao Feng Xiang; Hong Kong-based jewellers such as Chow Tai Fook and Chow Sang Sang; and American or European jewellery houses such as Tiffany, Bulgari and Cartier.

Many brands headquartered in Hong Kong or mainland China offer primarily 24-karat and 18-karat gold jewellery and jadeite/nephrite pieces that are traditionally consumer favourites. International jewellers often charge a higher brand premium and carry a wider variety of fine jewellery rather than pure gold items.

Shanghai Lao Feng Xiang Co Ltd was the highest-ranking mainland company in Deloitte’s Global Powers of Luxury Goods 2020 report, published last November. The jeweller ranked 16th out of the top 100 global luxury titans, for the second year running. Chow Tai Seng Jewellery Co Ltd and Zhejiang Ming Jewelry Co Ltd (Mingr) took the 61st and 75th spots respectively in the 2020 tally.

Of the Hong Kong-headquartered jewellers that generate most of their revenue on the mainland, Chow Tai Fook came in 8th, rising one notch from 2019. Chow Sang Sang, Lukfook and Tse Sui Luen ranked 30th, 31st and 73rd respectively.

But not all jewellery giants performed well in the perfect storm of 2020. In March 2021, two publicly listed jewellers were delisted from China’s A-Share stock market due to heavy losses. Eastern Gold Jade, ranked 42nd in Deloitte’s 2019 list, dropped out in 2020 due to a catastrophic decline in FY2019 net sales following major financial irregularities and losses. It had previously been considered the top jadeite stock in China. For its part, Gangtai Holding, a well-known online jeweller that once had a capital value of RMB 13.2 billion (US$2.03 billion), suffered a total loss of around RMB 6 billion (US$924 million) in 2019 and 2020. The two companies were delisted since their share prices fell to under RMB 1 (US$0.15) for 20 consecutive trading days.

The Covid-19 pandemic only accelerated market consolidation. Jewellers with weak access to financing, fuzzy brand positioning and fewer iconic products were more vulnerable in the turmoil. Meanwhile, companies with solid brand recall, omnichannel sales, stronger financing, strategic suppliers and broader pipelines flourished despite challenging conditions. Growth was likewise driven by expansion into lower-tier cities as these offer opportunities to develop market share.

E-commerce boom

Online shopping, already robust in China during pre-coronavirus days, gained ground during the lockdown and continues to thrive.

According to the Global Payments Report 2021 by Worldpay, a division of research firm and service provider FIS, China’s e-commerce market will expand by 70 per cent in the next four years to reach US$3.17 trillion in 2024, thanks to growing consumption on mobile devices. Moreover, e-Wallets, including Alipay and WeChat Pay, will increase their market share to 75 per cent of e-commerce payments. Payment-on-delivery will drop to less than 1 per cent.

In 2020, e-commerce sales on mobile devices in China reached US$1.18 trillion, more than thrice the amount for the US. E-Wallets accounted for over half of in-store payments. Debit and credit card payments are expected to increase by 7 per cent annually to cover 16 per cent and 15 per cent of in-store payments respectively by 2024. The use of cash, already on the decline, is projected to fall below 6 per cent by 2024, the report continued.

Jewellery brands are thus stepping up their presence on social, mobile and digital channels for greater engagement and market penetration in China.

Tiffany, Bulgari, Cartier and Louis Vuitton are among the international names that now offer jewellery and other luxury items through WeChat Chinese-language mini-programmes, which accept e-Wallet payments.

Online luxury

E-commerce platforms have likewise proven effective in reaching consumers throughout the country, particularly in Tier 3 and Tier 4 cities where there are fewer brick-and-mortar stores.

While the global luxury market shrank by 23 per cent in 2020, luxury consumption in China ballooned by 48 per cent, noted the China’s Unstoppable 2020 Luxury Market report by Tmall Luxury Division and Bain & Co.

The report cited Tmall as the new growth engine for e-commerce on the mainland. Since last year, more than 200 luxury brands have opened stores on the platform.

Wang Xiaoyin, head of Tmall Luxury Center, commented, “From the perspective of luxury brands, e-commerce is no longer just a sales channel but a marketing platform that can improve consumer awareness, enhance brand equity and attract new customers. Brands can leverage the nature of online channels to maximise their positive impact. For example, they can offer customised and limited-edition products, market insights, organise live streaming events, and integrated online and offline marketing.”

On March 20, Van Cleef & Arpels launched its e-store on Tmall, offering more than 100 products in six series including necklaces, pendants, bracelets, rings, earrings and watches. The flagship store also features Augmented Reality try-on, customised engraving and other special services.

Last year, Richemont worked with Alibaba Group to add some of its fine jewellery and watch brands such as Cartier, Montblanc, IWC Schaffhausen and Officine Panerai to the Tmall Luxury Channel and set up brand flagship stores online.

Shopping festivals also offer ample opportunities for sales in a market that favours discounts and promotions. Aside from traditional occasions like Chinese New Year and Valentine’s Day, online-initiated retail promotions such as the Double 11 Singles’ Day and the year-end Double 12 sale are highly successful. Less-celebrated festivals such as Qixi, China’s Valentine’s Day, have also been repackaged into commercial events.

While high-end jewellery pieces do not lend themselves to big discounts, fashionable jewellery at lower price points, especially those with small diamonds or gemstones, generally move well when there are online retail promotions.

Consumption shifts

Societal changes are likewise reshaping China’s jewellery retail landscape.

Wedding rates are down in China for a variety of reasons. Less than 10 million couples registered to wed in 2019, data from the Ministry of Civil Affairs showed. This number fell further in 2020 to a 17-year low of 8.13 million, due largely to the Covid-19 pandemic. The downturn is likely to continue in the years to come.

In 2018, China had 240 million single adults, 77 million of whom chose to live alone. Of the latter, highly educated women outnumbered their male counterparts, especially in Tier 1 cities. Female professionals are becoming more financially and intellectually independent, and many do not view marriage as a necessity.

While this trend may impact wedding jewellery sales, self-purchases from the growing middle class and increasingly affluent professionals are expected to offset the decline.

Product-wise, Chinese consumers remain partial to plain gold jewellery, which usually comprises over 60 per cent of many jewellers’ inventories.

Handsome Wang, chief spokesman of Shanghai Lao Feng Xiang Co Ltd, said the Chinese market sees gold jewellery as a profitable investment with intrinsic value. It is favoured not only by older consumers but also by the younger generation, which has higher expectations of craftsmanship and design.

“Consumers’ tastes have changed from pure gold and heavy items to more diverse pieces. Lao Feng Xiang has created a wide variety of gold jewellery pieces that are lighter, more intricate in design, and showcase innovation in materials and technology,” he disclosed.

Material interest

China’s diamond sector is also rebounding from the slump in the pandemic’s early days.

The nationwide lockdown in February and March 2020 took a toll on diamond retail as couples postponed their nuptials during the traditional wedding seasons of Chinese New Year in February and Labour Day in May.

Diamond consumption rallied after lockdown restrictions were eased, with diamond imports surging in the last quarter of 2020.

Data from the Shanghai Diamond Exchange showed that net imports of polished diamonds from January through March 2021 reached US$722 million, a 392.9 per cent year-on-year increase and a 25 per cent hike over the same period in 2019.

Coloured gemstone jewellery, currently comprising less than 10 per cent of most jewellers’ portfolios, also emerged last year as a potential crowd-drawer in the mainland market.

Boosting its prospects was the completion of Chow Tai Fook Jewellery Group’s acquisition of coloured gemstone jeweller Enzo, which has some 60 points of sale in Tier 1 and Tier 2 cities. This would widen Enzo’s reach to Tier 3 and Tier 4 cities, opening new customer bases for coloured gemstone jewellery.

“Coloured gemstones, particularly rubies, sapphires and emeralds, started to gain popularity in 2013 and 2014. Momentum accelerated in 2015 and 2016, as awareness rose among more jewellers and consumers,” said Lin Xifeng, president of Guangdong Colored Gemstone & Jewelry Chamber of Commerce.

Demand grew stronger in 2020 when more local celebrities and movie stars donned coloured gemstone jewellery, raising the category’s profile in the market. Online sales also went up for affordable jewellery pieces with smaller coloured gemstones in gold or silver, making these more accessible to consumers.

Prices of good-quality rubies, sapphires and emeralds even increased by 30 per cent in China last year owing to coronavirus-induced supply shortages, Lin revealed.

The expansive variety of coloured gemstones ensures widespread customer appeal. They are ideal for self-purchases, and the more important stones make for good investments, he added.

Wang agreed. "Coloured gemstones need to be promoted more aggressively. Lao Feng Xiang introduced entry-level jewellery pieces to entice the younger generation of consumers to appreciate coloured gemstones and to pave the way for their purchase of higher-value products in the future,” he commented.

Personalised selections

Indeed, younger consumers are fast emerging as the main force of China’s luxury market. Consultancy firm McKinsey & Company said consumers born in the 1980s and 1990s account for 43 per cent and 28 per cent of luxury buyers in China, respectively, contributing 56 per cent and 23 per cent of total luxury consumption in the country.

Millennials and Gen Z consumers seek higher levels of self-expression and place greater importance on sustainability than the generations before them. They therefore tend to favour personalised products over mass-produced items.

While customisation was once reserved for high-end jewellery, smart manufacturing using 3D printing, CAD software, CNC machines and other advanced technologies now enables rapid production of affordable personalised jewellery. This Customer-to-Manufacturer (C2M) approach of selling jewellery before manufacturing them allows retailers to reduce inventory levels and capital outlays.

“The goal of C2M is not to eliminate wholesalers and retailers. In fact, C2M relies on smooth coordination between retailers and factories, and the service is completed through wholesalers and retailers. It requires the collective effort of all segments in the industry to serve the needs of consumers,” explained Ren Jin, founder and CEO of Shenzhen Future Wisdom Jewelry Co Ltd and deputy secretary general of the Gems and Jewelry Trade Association of China.

The Global Diamond Report 2020-21 by Bain & Co and the Antwerp World Diamond Center noted that China’s new sales channels like live streaming and social media platforms such as WeChat, Weibo, TikTok and Red; online store sales such as Taobao, TMall and JD; and VIP membership sales afforded retailers greater interactive engagement with customers while earning them double-digit growth.

Retailers also work with new brand ambassadors, Key Opinion Leaders (KOLs) and Consumers (KOCs) popular among the Gen Z crowd to promote products and influence sales.

The Chinese luxury consumer

Insights from “China’s Unstoppable 2020 Luxury Market” report by Tmall Luxury Division and Bain & Co

• The luxury goods market in mainland China started to rebound in April 2020 after the nationwide lockdown was lifted.

• Mainland China’s share in the global luxury market nearly doubled in 2020, jumping from around 11 per cent in 2019 to 20 per cent in 2020. It is expected to become the world’s biggest luxury market in 2025.

• With uncertainty still surrounding international travel, Chinese consumers are likely to continue diverting discretionary income to luxury goods such as jewellery for at least another year, yielding an estimated 30 per cent growth in domestic luxury sales in 2021.

• Chinese luxury consumers will start travelling again in 2022 or 2023. Luxury brands in China have till then to enjoy diverted spend and convince customers of the advantages of domestic shopping.

• Gen Z and Millennial consumers will continue to buy luxury goods. Nearly 75 per cent of them will increase or maintain their luxury spend in 2021.

• Chinese Gen Z consumers spent five hours a day on mobile devices in 2020, 10 per cent longer than average, so their top sources of information on luxury goods are digital. E-commerce, Little Red Book and brands’ Chinese websites or apps are their three top sources of information.

• Chinese luxury consumers’ online shopping behavior has changed permanently since the lockdown. Nearly 80 per cent of them plan to increase or maintain their share of online luxury shopping over the next few years.