E-commerce is booming in China, and the country’s jewellers are carving a lucrative niche in the online marketplace. Jewellery transactions online are poised to grow on the back of omnichannel strategies, social media platforms, new business models and the boom in livestreaming.

Rapid developments in China’s telecommunications infrastructure have spawned a thriving online marketplace. As fiber-optic high-speed Internet and 5G network expand in the country, 64 per cent of 1.4 billion Chinese nationals use smart phones to surf the Internet. China has led the world in mobile payment coverage for years. Faster Internet speed, bigger screen sizes and advanced in-phone cameras turn video and livestreaming into lucrative channels, and social media transforms users from information receivers to communicators.

Adoption may have been accelerated and accentuated by coronavirus-driven restrictions, but e-commerce has long been an integral part of China’s jewellery business.

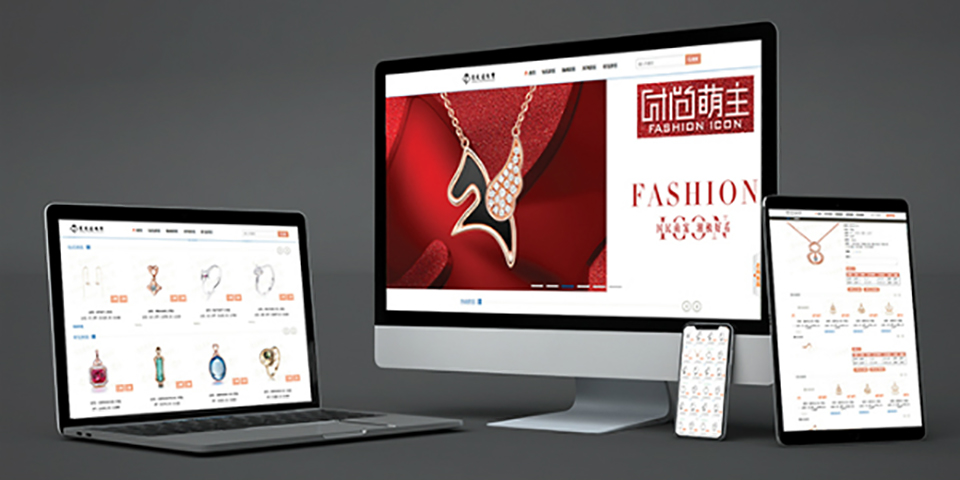

The country’s online jewellery market has evolved significantly in the last decade with the advent of new business models and channels. Internet and mobile technology are integrated into both B2C sales and B2B transactions.

Retailers embrace several variations of online-to-offline-to-online synergies. Consumers take on a greater role in the creation of their jewellery. Trade show visitors sell goods before buying. Retailers place orders with manufacturers online anytime, anywhere. Social media platforms turn transactional with group purchases and employee engagement boosting sales.

New retail

At the 2016 Alibaba Apsara Conference in Hangzhou, then Alibaba Group Chairman Jack Ma remarked, “In the next 10 to 20 years, there will be no concept of e-commerce, only the New Retail.”

In China’s jewellery market, this translates into omnichannel strategies. Traditional retail is complemented by online flagship stores, a presence on online shopping platforms, strong WeChat engagement, influencer and celebrity endorsements, social media activities and/or video and livestreaming campaigns.

Traditional retailers actively use the technology of mobile network, big data, digital supply chain and even blockchain to constantly upgrade their business processes while enhancing physical stores with new retail smart terminals.

Chow Tai Fook Jewellery Group Ltd installed Cloud Kiosks at key locations in Tier 1 and 2 cities. These online-to-offline (O2O) hubs link online orders at stores to its e-commerce platform.

Chow Sang Sang Holdings International Ltd launched its official e-commerce platform in 2001 and tapped online marketplaces such as Tmall and JD.com in 2010. “Among jewellery retailers, we have the most consistent product lines in-store and online,” shared Winston Chow, the group’s director and deputy general manager. For instance, its MintyGreen brand of personalised jewellery for young consumers is offered both online and offline. The brand’s Charme Collection of mix-and-match beads in 24-karat gold includes special series inspired by popular animated movies and online games.

For their part, e-tailers take advantage of their Internet genes to expand customer flow through online sales platforms and channels while opening brick-and-mortar stores and showrooms under the O2O business model. Diamond and wedding jewellery retailer Zbird, which started online, added customised order stations at some of its physical stores.

These two distinctive integration journeys in China’s new retail build on the advantages of each niche while expanding their market through additional channels. Traditional retailers are experienced in the operations and management of brick-and-mortar stores. E-commerce jewellers, on the other hand, are experts in new retail technology, traffic acquisition by online channels, and higher brand recognition among younger millennial consumers.

“When it comes to industry development, there is no strict boundary between traditional jewellery retail and e-commerce jewellery,” said Zbird Chairman Stone Xu.

Every significant jewellery brand in China now has its own e-commerce department as well as flagship stores on online shopping platforms such as Taobao, Tmall, JD.com and Pinduoduo. Some even have their own livestreaming business system and teams. Chow Tai Fook works with as many as 90 online platforms in China and even surpassed e-tailers in online sales during commercial festivals such as Singles' Day on November 11.

Alternative shopping channels, including WeChat mini programs, group buying and team purchase, are thriving alongside dominant e-commerce platforms, according to International Colored Gemstone Association (ICA) President Clement Sabbagh. “Group buying allows consolidated shipments to the central buyer in Hong Kong,” he said.

Diversified channels

While WeChat lags behind the established e-commerce platforms in terms of online sales, it is now arguably the social network tool of choice for the jewellery industry. Equipped with its own WeChat Pay system, the versatile channel includes mini programs and public accounts that 1.2 billion WeChat users can access and buy from conveniently.

Jewellery companies, regardless of size and scale, see the value of a WeChat presence. Larger retailers drive sales through mini programs, livestreaming and special features such as Do-It-Yourself (DIY) customisation.

In May, Zbird launched its Wedding Ring Master app on WeChat. The breakthrough technology, which took three years to develop, caters to millennial consumers by addressing their need for self-expression and involvement, and the current “stay home” culture. Customers get to create their very own ring by taking over the design process. The app allows them to pick from 200,000 diamonds from around the world for their centre diamond, and then select their preferred side stones, metal, prongs and shanks, among others. Designs may be visualised through the app’s 3D try-on simulation feature. The 3D rendering can be transferred to the 3D wax printers in Zbird stores for an immediate wax model or sent to the company's manufacturing facility to be turned into finished rings.

The DIY design and try-on app includes customers in the creative process and provides Zbird with an innovative and engaging product, fresh sales opportunities and substantial cost savings.

The one-of-a-kind rings entail careful logistics management as each item is customised and delivered to customers within a reasonable timeframe. This C2M (Consumer to Manufacturer) sales model however reduces inventory levels dramatically and frees up funds.

Since the mini program’s launch, over 10,000 people have registered as members, with successful sales recorded within the first 10 days. Over 95 per cent of members said they would consider using the app to design their own rings.

Chow Tai Fook also adopts the C2M business model to reinforce customer experience through personalised engagement in the manufacturing process. According to Executive Director Bobby Liu, the group’s new C2M experience centre in Shenzhen enables customers purchasing on D-ONE, its online jewellery customisation platform, to witness the jewellery production journey of their order in person.

Social variations

While the big brands develop flagship stores, member service centres and mini programs on WeChat, smaller businesses likewise avail themselves of the platform’s many possibilities.

Chinese online sellers often visit international jewellery trade shows in Hong Kong for immediate buy-and-sell opportunities, with a client list comprising retailers, wholesalers and consumers on the mainland. They typically gather demand from potential customers before the show, seek appropriate products at the fairground, and post their pictures and details on the platform. The WeChat Moments function allows up to 5,000 contacts to view the posts. The Messenger function enables prompt communication with potential clients, while the WeChat Pay service delivers clients’ deposits or full payments to the buyer.

In this business model, online players can sell the goods at a profit without any direct cash outlay and even before purchasing a single item at the show. WeChat thus affords these establishments a low-cost channel for e-commerce with minimal to non-existent operational costs, inventory and startup investment.

By the same logic, plenty of gem and jewellery dealers sell on WeChat when visiting industry hubs such as Thailand, Israel and Brazil.

ICA’s Sabbagh describes the phenomenon as a modern version of agent matchmaking between suppliers and buyers. “This on-time and on-demand business channel makes sourcing easier, especially for the agents who no longer need to carry huge inventory for their clients. Selling through this network has been more prevalent and less costly, aligning with the trend of rational and smart spending,” he remarked. “For gemstone companies, it is a matter of adapting to and embracing this new behaviour, which may become a very profitable business channel for our industry.”

Client engagement

Small to medium-sized jewellery manufacturers also turn WeChat into direct sales channels. Some recruit agents to promote their products on WeChat Moments or mini programs. This grassroots approach of making suppliers’ stock available to the contact lists of WeChat buyers and agents enables jewellers to expand their reach and increase sales.

Various forms of staff sales engagement have likewise emerged. Chow Tai Fook’s new tailor-made O2O sales channel, Cloudsales365, sees employees continuously promoting and selling goods on social media.

“Based on the popular WeChat app, Cloudsales 365 allows our staff to respond to customer enquiries and needs, recommend products, send invitations to our stores and provide personalised services, among others,” explained Liu.

The retailer has connected with over 460,000 customers since the platform’s launch in early January, driving more than 4.7 million visits to its e-store, which in turn translated to 35 per cent of online sales volume through CTFMall.

Livestreaming in focus

Livestreaming has evolved into a leading digital tool for e-commerce. Sales figures on the channel remain on an upward trajectory, prompting platforms and venues to mushroom in the jewellery space.

Jewellery livestreaming sessions in China come in various forms. Essentially the interactive sessions see the host showcasing the jewellery piece – and sometimes the manufacturing process – and viewers placing orders in real time. Many sessions take place in dedicated rooms at livestreaming complexes. A popular format sees hosts sitting on one side of a long table, with various suppliers taking turns to sit on the other side and present their products. At times, hosts make do with just a table or a booth or conduct the session at the supplier’s store or counter.

Alibaba’s Taobao Livestreaming platform, launched in 2016, adopts the online mall philosophy of providing distinctive sales environments and shopping experiences. According to its latest report, 51.8 per cent of all jewellery sales on Taobao.com and Taobao Livestreaming combined are generated by livestreaming accounts. Jewellery sales currently constitute 35 per cent of transactions on Taobao Livestreaming, and the top 100 jewellery businesses on Taobao derive 60 per cent of their sales from livestreaming.

The channel has proven lucrative for jewellers in China. The average total daily jewellery sales on Taobao Livestreaming is RMB 70 million (US$9.88 million). The highest ticket price recorded for a single item of jewellery on the platform is RMB 3.3 million (US$465,900).

Jewellery leads all sectors in the number of sessions on Taobao Livestreaming and comes in second in terms of transaction value. More than 40 jewellery livestreaming rooms on the platform have an annual sales capacity of over RMB 100 million (US$14.1 million).

Jewellery belts

The boom in business has led Taobao to set up Jewellery Industry Belt Livestreaming Bases that record RMB 32 million (US$4.52 million) worth of transactions daily. As of November 2019, bases had been set up in nine jewellery industry belts in China. Five of these livestreaming bases have an annual sales capacity of over RMB 1 billion (US$141.2 million), while transactions at more than 40 jewellery livestreaming rooms breach the RMB 100 million (US$14.1 million) mark every year. Jadeite jewellery is a particularly popular buy during livestreaming sessions on the Taobao platform.

Sihui City in Guangdong Province is a manufacturing and wholesale centre for low- to mid-priced jadeite jewellery. The Sihui Taobao Livestreaming Base, set up in 2017 inside the Sihui Wanxinglong Jadeite Market, demonstrates the synergy between the jewellery industry marketplace and the online platforms. Manufacturers reach online consumers who benefit from the cost-effective shopping experience.

Fang Guoying, founder of the Sihui Wanxinglong Jadeite Market and head of the Sihui Taobao

Livestreaming Base, said daily sales on the platform reach RMB 10 million (US$1.4 million) to RMB 20 million (US$2.8 million). “We provide technical and venue support to sellers in our marketplace. They can avail of our special features such as the monthly jewellery festival event, special banner positions, pop-up windows and special online events. We invite Taobao lecturers to provide training sessions and can arrange for experienced hosts for livestreaming sessions,” he said.

The independent Shuibei Jewellery Livestreaming Incubation Complex is a six-room facility in the Luohu District of Shenzhen, China’s jewellery manufacturing and wholesale hub. It has hosted sessions of at least 20 established jewellery brands.

Livestreaming works well especially when featuring KOLs and local government support, according to Lucas Lu, the head of the facility and vice president of Shuibei Jewellery Group.

“Seven jewellery brands including Cuihua, Allove and Sunfeel joined a successful group livestreaming event at our facility on May 5. The Shenzhen government provided special support by inviting seven hosts from the local television station to participate and cover the session. Each host teamed up with a jewellery brand during the livestream to engage and attract viewers. One of the brands even sold a piece for US$40,000 during the event,” Lu remarked.

B2B outreach

Technology is also driving business efficiencies for China’s jewellery sector. As domestic travel ground to a halt due to Covid-19 containment measures, jewellers had to abandon their usual practice of visiting manufacturing hub Shenzhen to review designs, inspect samples and place orders.

Xingguangda Jewelry, one of China’s largest jewellery manufacturers, relied on its new online M2B (Manufacturer to Business) platform to serve its 4,500 regular corporate clients around the country.

“The system has allowed hundreds of our clients in China to select from our designs and place orders anytime and anywhere from their desktops, mobile phones and tablets. By eliminating the need to come to our office, we save them time and money while increasing our efficiency tremendously in a lot of aspects. The large amount of data feedback allows us to analyse and predict demand patterns and trends, leading to more precise manufacturing and marketing efforts,” revealed Lin Changwei, chairman of Xingguangda Jewelry.

With 1,200 employees and 44,000 square metres of floor space, the company produces over a million pieces of jewellery per year.

Jewellery e-commerce trends in China, 2020

• Emergence of livestreaming as a powerful sales channel

• Shift from KOL (Key Opinion Leader) marketing to KOC (Key Opinion Consumer) marketing

• Short-video apps to facilitate e-commerce

• Growth of re-commerce or the selling/reselling of pre-owned goods

• Increased group buying of gemstones such as sapphires, with major e-commerce platforms launching group-buying functions

• Mini digital programs to supplement shopping platforms for brands

• Faster parcel delivery to and within China

• Data-driven C2M (Consumer to Manufacturer) model to provide base reference for business development

• Robust growth for vertical e-commerce sites due to targeted user experience

• Changing landscape of cross-border e-commerce

Source: International Colored Gemstone Association