Gemstones are a star performer in Thailand’s industry repertoire, with the country building a formidable reputation over the years as the preeminent producer of coloured stones, particularly corundum.

Thailand's long tradition of gemstone cutting goes back centuries to when rubies were discovered in the Chanthaburi province and extensive deposits of beautiful blue sapphires were unearthed in Kanchanaburi.

In the 1960s, when the Mogok mines of prized Burmese “pigeon's blood” rubies fell under military control, the global trade had to look elsewhere to fill the demand for gem-quality red stones. Since Thailand had the largest reserves of clean gem-grade rubies, the ingenious Thai gem traders learned to heat the darker Thai rubies to improve their colour. Through this “burning” process, Thai rubies became the new stars of the global market and gem cutting grew into a major part of the Thai industry. Increased demand for Thai rubies meant increased mining in the Trat, Chanthaburi and Kanchanaburi provinces to boost production. By the 1980s however, the mines were mostly depleted of their corundum deposits. Fortunately, the expertise developed by the Thais for heating and cutting gems proved to be the basis for the beginning of a great success story in the gems and jewellery world.

Today, Thailand's coloured stone industry relies on gems from outside of the country rather than local sources. Rough stones are brought in from every mining location in the world to be cut and traded, mostly in Bangkok and Chanthaburi. The industry's expertise in producing different enhancements, treatments and cutting skills has made Thailand the hub of the international coloured gemstone market.

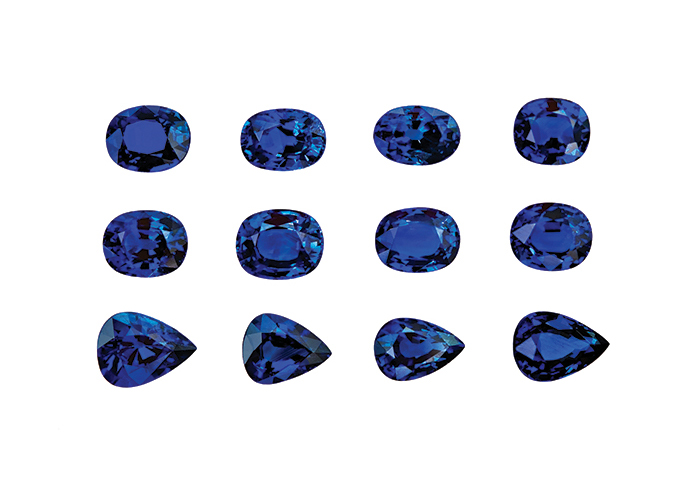

Corundum focus

In Thailand's world of gems, rubies and sapphires take pride of place. Given its history, the country has developed an expert eye – and hand – for corundum, mastering different cutting skills and treatments to emerge as the preeminent source of polished rubies and sapphires.

Its extensive inventory extends from calibrated sizes to single stones and layouts, and from gem-quality wonders and fine marvels to midrange options and low-grade stones.

Phuket Khunaprapakorn, president of corundum specialist Gemburi Co Ltd, attributes Thailand's supremacy in the coloured stone field to the Thai gemstone sector's experience and expertise in selecting gemstone rough from different regions and sources, its mastery of heating and polishing techniques to add value to the goods, and the availability of skilled labour throughout all stages of production.

“Favourable government policies also help entrepreneurs grow their business while enhancing the positioning of Thailand and specifically Chanthaburi as production and trading hubs for gemstones,” says Khunaprapakorn who now sits on the Advisory Board of the Chanthaburi Gem & Jewelry Traders Association, after a long tenure as

its president.

The sector also collaborates with international trade organisations such as the International Coloured Gemstone Association (ICA) and the World Jewellery Confederation (CIBJO) along with national gem and jewellery associations in various countries to maintain international standards and promote social responsibility, Khunaprapakorn remarks.

A testament to Thailand's esteemed position in the international gem trade is its hosting of the 19th ICA Congress 2019 in Bangkok from October 12 to 15. Thailand is the first country to host the event for the third time – 1987, 2005 and 2019. ICA Congress 2019 Chairman Prida Tiasuwan states, “Bangkok being the world's largest coloured stone trading and processing hub gives us an immense opportunity to create great awareness about coloured stones to a global audience who will share, network and enjoy this much-anticipated event.”

Market indicators

Despite the global economic slowdown and geopolitical challenges facing key markets, Thailand's gemstone sector is bullish of business prospects ahead.

Khunaprapakorn says, “Clients who still have stock may slow down their purchases and avoid big orders. But the majority of buyers will continue to purchase and order throughout the year due to their needs as well as the limited supply of goods.” He notes that demand remains robust for rubies and sapphires in small and calibrated sizes, which are in short supply. Single stones, especially those of higher quality, move well too. While China is still the main destination for Thai-manufactured stones, US and European demand is growing, especially from luxury and international brands, he discloses.

Penta Gems Co Ltd specialises in fine unheated rubies of 1 to 5 carats as well as fine heated and unheated sapphires of 1 to 10 carats. Founder Charoon Chokdeesataporn identifies good-quality, clean, heated and unheated rubies and sapphires of 1 to 5 carats as his company's fast-moving goods. China, the US, France, Hong Kong, Taiwan and Singapore are his major markets.

While corundum may be the bedrock of Thailand's gemstone industry, its manufacturers have exhibited equal prowess in the processing of other coloured stones. In this field, the country has developed a specialty in largely good-quality stones, on top of commercial goods. Aquamarines, tourmalines, fancy sapphires, spinels and topaz stones have been particularly in demand, traders note.

Looking ahead to 2020, Anthony Brooke, vice president of the Thai Gem & Jewelry Traders Association (TGJTA), says that sales of ruby rough from Mozambique continue to rise, with a similar pattern seen for Zambian emeralds. While there is still demand for the big three colours, this is dependent on the gems being from certain countries of origin and free from enhancements.