Hardly a major auction goes by these days without gemstones breaking world records. Prices have gone through the roof for rare and untreated Kashmir sapphires, Burmese rubies and Colombian emeralds, not to mention top prices fetched by fancy colour diamonds. Here’s a peek into various developments in the global gem market.

The gem market has traditionally concentrated on the so-called Big Four – diamonds, rubies, emeralds and sapphires. This is still the case to some extent but there is growing demand from consumers, millennials in particular, for non-traditional, unique gemstones with original cuts and colours that evoke their personalities. Even the price has become almost secondary to the “story” behind the gemstone as “experiential purchases” become increasingly important.

Telling the story

The story behind the gem is intricately interwoven with its origin and how it is mined and marketed. Diamond mining has long been dominated by large corporations while coloured gems have mostly been produced by small-scale and artisanal operations. Today, large companies have also become major players in the coloured gem sector, accounting for more than 20 percent of production. These industrial miners are extracting emeralds in Zambia and Colombia, and rubies in Greenland and Mozambique.

From a business perspective, these companies shorten the supply chain by auctioning their rough material directly to large cutting companies, consequently altering the marketing and sales models of stone dealers, jewellery manufacturers, retailers and small-scale miners. The lines are thus being blurred between actors along the supply chain, with increasing pressure on margins.

Another aspect of large corporations’ modern business models is telling the story behind the gems – one that includes responsible sourcing, ethical supply chains, transparency and corporate social responsibility.

These companies also help mining communities in general by supporting a variety of non-mine programmes while protecting the environment. The key elements of their marketing campaigns point out that consumers can “feel good” about their purchases, knowing that the gems benefit not only individual miners but entire communities.

Demand for transparency

Gemmological laboratories are tasked to come up with new ways to detect emerging gemstone treatments. According to Helen Molesworth, managing director of Gübelin Academy, labs are currently hot on the heels of a new sapphire treatment involving temperature

and pressure.

“The additional pressure applied to the heating environment appears to assist and quicken the heating part of the treatment,” she noted, adding that disclosure is an important element in gaining consumer confidence.

The Gübelin Gem Lab recently launched its Provenance Proof Blockchain technology, developed in partnership with Everledger, to trace coloured gems from mine to market. The method involves placing nano-particles into a rough crystal at the mine, which can be traced throughout the stone’s journey using blockchain. In this way, the gem’s owner can track it from mine to final customer.

Colombia’s Ministry of Mines and Energy meanwhile created a “Mineral Digital Fingerprint.” The goal is to understand particular conditions and physical-chemical characteristics that were present when a mineral is geologically formed, thus providing a specific gem DNA. This fingerprint can be traced at the different stages of exploitation, refinement and commercialisation

of minerals.

Spectacle of colours

High on the list of this year’s “hot colours” are pinks, reds and oranges, represented by spinel, ruby, sapphire, garnet, Imperial topaz, morganite and Padparadscha sapphire. Interestingly, the two latter gems call to mind Pantone’s Color of the Year, Living Coral.

“There’s strong demand for pink and red spinels, with rising prices,” noted Neil Kandira of Japan’s Anjali Gems. Rahul Jain of Hong Kong-based Caram shared this sentiment, saying pink, red and colour-change spinels, and Padparadscha sapphires are sought after.

In Europe and the US, warmer pink spinels, especially from Burma, are popular but spinels of all types and colours, including cobalt blue stones from Vietnam are also favoured, revealed Niveet Nagpal, CEO of US company OMI Gems. “Even the less expensive grey and purple varieties are becoming trendy choices for engagement rings and jewellery in the US,” he added.

Ioannis Alexandris, CEO of Germany’s Gemolithos, cited solid global demand for high-quality no-heat rubies of 5 carats and up despite tighter supply. Similar observations were made by Jeffery Bergman, CEO of Thai supplier Primagem. “Unheated Burmese Pigeon’s Blood rubies are in strong demand as supplies from Mogok, Namya and Mong Hsu dwindle. Exceptionally clean unheated rubies in open-medium to medium-dark reds are the most sought after, fetching the highest prices regardless of origin.”

Amid robust demand for warmer shades, gems in cooler hues such as blue sapphires are still best sellers in Europe and the US, with strong appreciation in Asia as well. According to dealers, teal and bi-colour gems also attract attention. Sailesh Lakhi, CEO of US-based Sparkles & Colors, said his teal sapphires garnered great interest. “We find this blend of colours in gems from 2 to 13 carats, with 2 to 5 carats the most common.” Bluish-green bi-colour sapphires likewise move fast, explained Alexandris.

Unusual bluish-green colours in other stones are also being noticed, remarked Zoe Michelou of Thailand’s Imperial Colors. “At recent shows, our ‘Lagoon’ tourmalines – a mix of blue and green, without yellow overtones – have enjoyed success.” Molesworth also noted an increase in demand for blue spinel in a variety of hues.

Aquamarine remains highly appreciated, especially those in saturated tones. Paraiba tourmaline is also widely popular amid rising prices. Due in part to the demand for and scarcity of the neon blue tourmaline, a number of dealers are offering it in its matrix or as slices, with unlimited possibilities for jewellery design. Blue zircons are also popular, with some supplies coming out of Cambodia, explains Constantin Wild, CEO of his eponymous company.

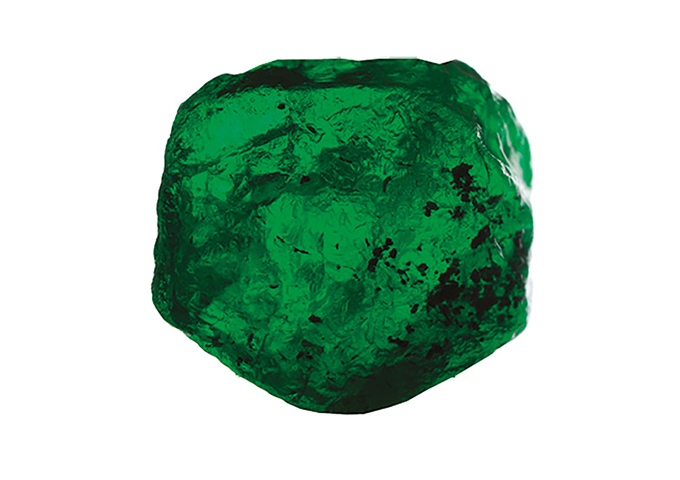

Among the most popular gems at the green end of the “cool” spectrum are emeralds and tourmalines. Alexandris noted an “extremely high demand from China for no-oil emeralds from the Muzo area in Colombia, with a dark saturated green colour.” Chen Shen, gem dealer and owner at China’s Skywalk Global, added, “Nice gem-quality no-oil Colombian emeralds are among the most coveted gems in China but are nearly impossible to find.” Caram’s Jain said the overall market is strong for Zambian emeralds, which the company often displays as matched pairs or sets.

A new source of emeralds from Ethiopia made headlines a couple of years ago. “Demand for Shakiso Ethiopian emeralds continues to grow as more designers discover its rich vivid greens. Production from the mines has however fallen significantly as digging deeper becomes more challenging and costly,” explained Primagem’s Bergman. Lakhi also noted that with their saturated colours, Shakiso gems resemble Colombian emeralds but are half the price. Adding to the gems’ popularity are social responsibility and ethical sourcing. The mine is owned and operated by a tribe of 3,000 people and the money generated goes to the tribe.

With a mystique dating back to the 14th century, jade is a major gem in China and other Asian nations. It also has a following in the West. “Many of my clients purchase high-end Burmese jade as an investment,” said David Lin, president of US-based Jades by David Lin. “Prices of mid- to high-quality material continue to climb while lower-end goods are fairly stable,” he said, noting that lavender, red, black and white jade are also desired by buyers.

Other gem varieties

A new species of sapphire, aptly dubbed Gold Sheen™ sapphire by Tanzim Khan, CEO of Thailan’s Genuine Gems and Jewellery, is making waves in the gem market.

Khan, who owns the entire production of the unusual gem, said the gem exhibits colours from gold to translucent blue and green. Its sole source was a now depleted mine in Kenya. Lab reports confirm that the golden gems are natural unheated sapphire.

Still in the realm of sapphires, a new bluish mineral was discovered in Israel in 2018. Named carmeltazite after Mount Carmel, it contains zirconium, titanium and aluminium, and is found as an inclusion in a certain type of sapphire, which has been named Carmel Sapphire™.

Another stone, discovered in southern Madagascar in 1902, is the rare grandidierite. According to Bergman, the stone has grown in popularity and supply. “In pastel to vivid greenish blue colours, it has a hardness of 7.5. Large quantities of cabochon-grade material are available with eye- to loupe-clean stones, although it is quite scarce above one carat,” he added.

Opal, especially from Australia, is a staple in today’s upmarket jewellery. Prices, which peaked in the late 1980s and 1990s and then declined, seem to be on the rise again, according to Daniel Hopkins of Australian dealer Hopkins Opal, which specialises in Lightning Ridge black opal.

The world of quartz meanwhile offers bold tones of amethyst and citrine as well as soft hues of prasiolite, rose and smoky quartz. The quartz family also includes the cryptocrystalline varieties known as chalcedony, jasper and agate – gems that are gaining steam among artisanal designers.

The so-called “ornamental” stones – rhodochrosite, agate, chrysoprase, malachite, rhodonite, sugilite, lapis lazuli and others – were used by prestigious Place Vendôme brands during the 1970s before falling out of favour in the mid-1980s. These gems have since resurfaced in the last couple of years. Social media also helped raise the profile of some of the lesser-known “ornamental” varieties.

Provenance and quality

Regardless of current trends, dealers agree unanimously that quality is important. High-quality, non-treated stones of all types are in large demand and short supply. “High-end gems command very high prices,” noted Molesworth of Gübelin Academy.

Elke Berr, president of Switzerland’s Berr & Partners SA, has tracked the price of precious gems for many years through auctions, private sales and other published data. In her 2019 edition of “Matières Premières d’Exception,” Berr’s research confirmed what dealers have been saying. The prices of 5-carat no-heat Burmese rubies far outstripped those of Mozambique rubies, although prices have risen for both. Heated Burmese rubies increased only slightly over the same period. Ten-carat no-heat Burmese sapphires enjoyed much higher prices than Ceylon sapphires, which have been fairly stable over the last four years. Prices of 10-carat heated sapphires (one-fifth to one-third the value of Burmese and Ceylon stones) have been stable over the last few years. For emeralds, the data showed that 10-carat minor-oil Colombian stones command prices nearly double those of Zambian emeralds, although both have been rising significantly over the last ten years.

For 2019, Berr said Colombian emeralds will continue to lead their Zambian cousins, with minor or no-oil stones on top. Kashmir sapphires meanwhile are seen to become even rarer; Burmese gems will continue as a market leader. She further noted that ruby prices will probably remain stable, although the situation of the Rohingyas in Myanmar may affect future Burmese sales.

Consensus seems to be that the market for high-end, untreated goods will continue to be strong due to tightening supplies. Prices for less expensive gems and lower-quality goods due to larger production will continue to be soft. The US remains the main market for coloured gems of all kinds but with China slowing down, new markets such as Indonesia and Malaysia and old favourites such as Japan and Taiwan may pick up the slack for gem and jewellery.

What is clear going forward is that type and colour are only part of the gem story. Consumers are concerned about the integrity of the supply chain, and want to know that their beautiful purchases are helping miners, cutters and others along the way.